Planning your dream vacation for 2025 starts not with booking a flight, but with a solid financial plan. The most effective way to save for travel is by establishing a detailed budget using a dedicated tool like the [Cnfans Spreadsheet 2025 Travel Budget Table](https://www.cnfan-spreadsheet.com/). This allows you to meticulously track income, pinpoint and reduce daily expenses, automate consistent savings transfers, and later apply smart booking strategies to maximize the value of your travel fund.

Table of Contents

- What is the Cnfans 2025 Travel Budget Table?

- Phase 1: Establishing Your 2025 Travel Foundation

- Phase 2: Activating Your Daily and Weekly Savings Strategy

- Phase 3: Supercharging Your Income and Savings

- Phase 4: Smart Booking to Protect Your Budget

What is the Cnfans 2025 Travel Budget Table?

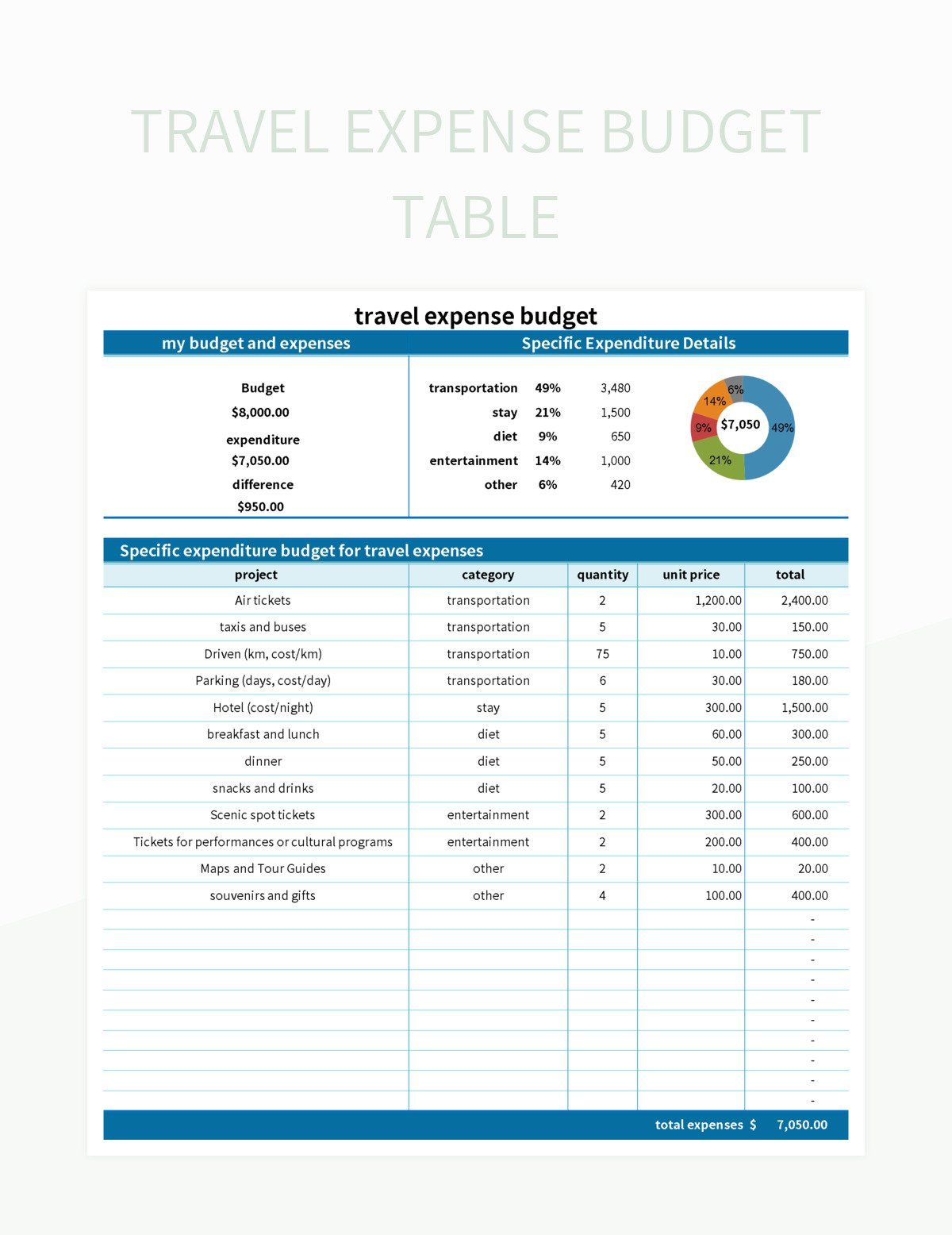

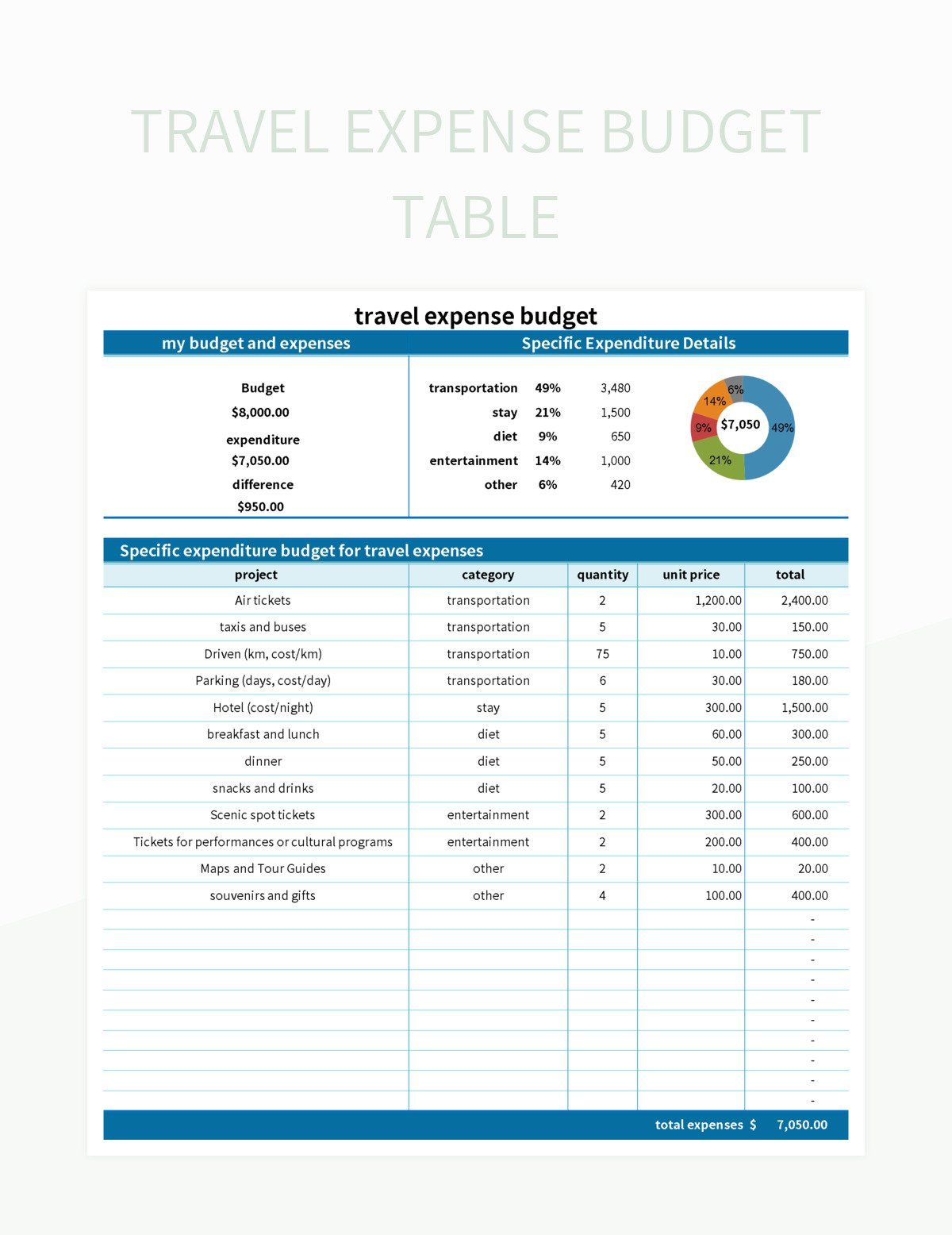

Achieving an ambitious savings goal requires more than just willpower; it demands a powerful tool for organization and tracking. The [Cnfans Spreadsheet 2025 Travel Budget Table](https://www.cnfan-spreadsheet.com/) is a comprehensive digital ledger designed to transform your travel dreams into a financial reality. Moving beyond simple notes, this spreadsheet provides a structured framework to meticulously plan, monitor, and manage every dollar dedicated to your vacation fund. It is built on the same principles of detailed tracking and cost management that Cnfans users trust for their international shopping.

This specialized table empowers you to input your destination, estimate costs across various categories, set a final savings target, and visualize your progress over time. With features for categorizing expenses, calculating required weekly savings, and adjusting for unexpected costs, it serves as your central command center for financial planning. It turns the abstract idea of "saving for a trip" into a concrete, actionable project with clear milestones and measurable success.

Phase 1: Establishing Your 2025 Travel Foundation

Before you can save a single dollar, you need a clear target. This initial phase is about building the blueprint for your savings journey. It involves moving from a vague wish to a specific, costed-out plan. A well-defined foundation prevents you from saving too little or giving up because the goal feels unattainable. Every decision made here will inform the practical steps you take later.

How to Define Your Travel Destination and Dream Itinerary

Vague goals lead to vague results. Instead of saying, "I want to go to Southeast Asia," specify your plan: "A 14-day trip through Thailand and Vietnam, visiting Bangkok, Chiang Mai, and Hanoi." This level of detail is critical because it directly impacts your budget. A luxury resort stay has a vastly different price tag than a backpacker's hostel tour.

Consider the type of experience you want. Are you seeking adventure, relaxation, or cultural immersion? Answering this question helps you prioritize activities and allocate funds accordingly. Outline a rough day-by-day itinerary, listing major sights you want to see and experiences you want to have. This exercise isn't about creating a rigid schedule but about identifying the primary cost drivers of your trip.

Researching and Estimating Total Trip Costs Accurately

With a destination and itinerary in mind, it's time for research. Break down your anticipated expenses into clear categories within your travel budget spreadsheet. This is the most crucial step for setting an accurate savings goal. Your estimate should be thorough and slightly conservative to account for unforeseen expenses.

Use online travel sites, blogs, and forums to find current price ranges. Your primary categories should include:

| Expense Category | Description & Research Tips | Estimated Cost |

|---|---|---|

| Flights | Use flight comparison tools to check prices for your target dates. Look at costs for different times of the year. | $1,200 |

| Accommodations | Research average nightly rates for hotels, Airbnb, or hostels in your chosen cities. Multiply by the number of nights. | $900 ($75/night x 12 nights) |

| Food & Drink | Estimate a daily food budget. Factor in a mix of street food, casual restaurants, and a few nicer meals. | $700 ($50/day x 14 days) |

| Activities & Tours | List entrance fees for museums, parks, and temples. Add costs for guided tours or special excursions. | $400 |

| Local Transportation | Budget for subways, buses, ride-sharing services, or domestic flights/trains between cities. | $250 |

| Miscellaneous Buffer | Crucial for unexpected costs. Always add 10-15% of your subtotal for souvenirs, visa fees, travel insurance, and emergencies. | $517 (15% of subtotal) |

| Total Estimated Cost | The grand total becomes your primary savings goal. | $3,967 |

Setting a Realistic Savings Goal and Timeline in Your Spreadsheet

Once you have your total estimated cost—for example, $4,000—you need to determine how you will reach it. Input this number as the "Target Goal" in your Cnfans Spreadsheet 2025 Travel Budget Table. Next, decide on your travel timeline. If you plan to travel in 12 months, your path is clear.

The spreadsheet can automatically calculate your required savings rate: Total Goal / Number of Months = Monthly Savings Target. In this case, $4,000 / 12 months = approximately $334 per month. Seeing this specific, recurring number transforms an intimidating large sum into a series of achievable monthly steps. If the monthly target seems too high, you have two options: extend your timeline or revisit your budget to find areas to cut costs.

Phase 2: Activating Your Daily and Weekly Savings Strategy

With a clear goal set, the focus shifts to execution. This phase is about making tangible changes to your spending habits to free up the cash needed to hit your monthly savings target. Success here is built on consistency and conscious financial choices. The goal is to make saving for travel an integrated part of your financial life, not an afterthought.

Identifying and Slashing Your "Expense Vampires"

Expense vampires are the small, recurring costs that drain your bank account without you noticing. Think of the $5 daily latte, the $15 lunch delivery, or the multiple streaming subscriptions you rarely use. While seemingly insignificant on their own, they collectively consume a huge portion of your potential savings. Your first task is to conduct a "spending audit."

For one month, track every single expense. Use the categorization feature in your budget spreadsheet to see exactly where your money is going. You will likely be surprised. Once identified, be ruthless. Cancel redundant subscriptions, commit to brewing coffee at home, and start meal-prepping your lunches. Redirecting the $100-$300 saved each month from these changes directly into your travel fund can significantly accelerate your progress.

The 50/30/20 Rule: A Modern Approach to Budgeting for Travel

The 50/30/20 rule is a popular and effective budgeting framework for allocating your after-tax income. It provides a simple yet powerful structure for managing your money. The standard breakdown is:

- 50% on Needs: Essential living expenses like rent/mortgage, utilities, groceries, and transportation.

- 30% on Wants: Discretionary spending such as dining out, shopping, entertainment, and hobbies.

- 20% on Savings & Debt Repayment: Contributions to retirement, emergency funds, and paying down debt.

To aggressively save for travel, you can temporarily modify this rule. For instance, you might adopt a 50/20/30 split, trimming your "Wants" category from 30% down to 20% and redirecting that extra 10% of your income directly into your travel savings. This structured approach ensures you are saving with intent rather than just putting away whatever is left over at the end of the month.

Automating Your Savings: The "Set It and Forget It" Method

Human discipline is finite. The single most effective strategy to ensure you meet your savings goals is to remove the need for daily willpower. Automate your savings. Set up an automatic transfer from your primary checking account to a separate, dedicated savings account—preferably a high-yield one to let your money earn interest.

Schedule this transfer to occur the day after you get paid. This "pay yourself first" approach means the money for your travel fund is put away before you even have a chance to spend it on something else. Whether it's $84 a week or $334 a month, automation makes saving effortless and non-negotiable, turning it into a fixed expense just like your rent.

Phase 3: Supercharging Your Income and Savings

Cutting expenses can only take you so far. To reach your goal faster or to fund an even more ambitious trip, you need to increase your income. This phase is about proactively creating new revenue streams and making your existing money work harder for you. Every extra dollar earned is a dollar you can put directly toward your travel fund without impacting your regular budget.

Leveraging Side Hustles and the Gig Economy for Your Travel Fund

The modern gig economy offers countless opportunities to earn extra money on a flexible schedule. The key is to find something that fits your skills and lifestyle. Options range from freelancing online (writing, graphic design, virtual assistance) to local services (dog walking, food delivery, handyman tasks).

A powerful motivational trick is to mentally earmark your side hustle income for specific parts of your trip. For example, the money from a month of weekend food deliveries could pay for all your activities and tours. The earnings from a freelance project could cover your round-trip flight. This direct connection between work and reward provides a powerful incentive to keep going.

Maximizing Credit Card Rewards and Travel Points

When used responsibly, travel rewards credit cards are one of the most potent tools for reducing travel costs. The strategy is twofold: generous sign-up bonuses and optimized daily spending. Many premium travel cards offer bonuses worth $500 to over $1,000 in travel after meeting a minimum spending requirement in the first few months.

Beyond the bonus, use the card for your regular, budgeted expenses (groceries, gas, bills) to accumulate points on every dollar you spend. Be sure to select a card that offers bonus points in categories where you spend the most. This strategy comes with a critical warning: it is only effective if you pay off your balance in full every single month. The high interest rates on these cards will quickly negate any rewards earned if you carry a balance.

Phase 4: Smart Booking to Protect Your Budget

You have worked hard to build your travel fund. Now it's time to spend it wisely. This final phase is about stretching every dollar to get the most value. Smart booking can save you hundreds, or even thousands, of dollars, allowing you to either keep that money for your next trip or upgrade your current one. This is where your research and flexibility pay off.

When is the Best Time to Book Flights and Accommodations?

Timing is everything when it comes to booking travel. While there is no perfect formula, general guidelines can help you secure better prices. For international flights, start looking 3 to 6 months in advance. For domestic travel, a window of 1 to 3 months is often the sweet spot. Avoid booking too early or too late, as prices tend to be highest at these times.

Use fare-tracking tools like Google Flights or Hopper to set up alerts for your desired route. These services will notify you when prices drop, allowing you to book at an opportune moment. For accommodations, booking further in advance is often better, especially if you are traveling during peak season or have your heart set on a specific property.

Unlocking Deals with Flexible Dates and Alternative Airports

Flexibility is your greatest asset in finding travel deals. If your dates are not set in stone, you can unlock significant savings. Flying on a Tuesday or Wednesday is almost always cheaper than flying on a Friday or Sunday. Traveling during the "shoulder seasons"—the months just before and after the peak season (e.g., May or September for Europe)—offers a fantastic combination of pleasant weather, fewer crowds, and lower prices.

Expand your search to include alternative airports. Many major cities are served by more than one airport, and the budget carriers often fly into the smaller, secondary ones. The savings on the flight can often more than compensate for the minor inconvenience of a slightly longer journey into the city center. Being open to these adjustments can make a substantial difference to your bottom line.