The most cost-effective way to pay for items found using the CNfans spreadsheet is to use a dedicated third-party money transfer service, such as Wise (formerly TransferWise), to top up your shopping agent's balance. This approach significantly minimizes currency conversion fees and offers exchange rates close to the mid-market rate, which are the largest hidden costs when purchasing from international sellers. While direct payment methods like PayPal are convenient, they often include inflated exchange rates and additional service charges that can substantially increase the total cost of your haul.

Table of Contents

- What Influences the Total Cost of Your Haul?

- Why Does Your Choice of Payment Method Matter?

- How Do You Compare Different Payment Options?

- What is the Process for Using Wise to Fund Your Agent Account?

- Should You Top Up Your Agent Balance or Pay Per Transaction?

- How Can You Minimize Shipping Costs to Maximize Savings?

- Are There Other Hidden Costs to Consider?

- Putting It All Together: A Cost-Saving Checklist

What Influences the Total Cost of Your Haul?

Achieving a truly cost-effective purchase involves managing several financial components, not just the price tag on an item. The initial step to saving money begins with finding the best products at the lowest price. Tools like the CNfans spreadsheet are invaluable for this, aggregating listings and helping you identify top-tier sellers and batches. Once you have selected your items, the total expense is a sum of four key areas: the item cost, agent service fees, payment processing fees, and international shipping charges. Each stage presents an opportunity for savings, and overlooking any one of them can negate the benefits gained elsewhere.

The price you pay is rarely just the item's cost converted to your local currency. Shopping agents, while essential for bridging the gap between you and Chinese marketplaces, add their own service charges. More significantly, the method you choose to pay your agent introduces another layer of costs, primarily through currency exchange. Finally, the expense of shipping the consolidated package from the agent's warehouse to your doorstep is often the single largest portion of the total budget. A holistic approach to cost reduction requires careful consideration of every step.

Why Does Your Choice of Payment Method Matter?

The payment method you select can be the difference between a great deal and an unexpectedly expensive purchase. This is because different payment processors and financial institutions handle international transactions in vastly different ways. The primary differentiator is not the visible "service fee" but the *hidden cost* embedded within the currency exchange rate. A seemingly small percentage difference in the exchange rate can add up to a significant amount, especially on a large haul. Making an informed choice here is a critical lever for controlling your budget.

Understanding Currency Conversion Fees

When you pay for goods priced in Chinese Yuan (CNY) using your local currency (e.g., USD, EUR, GBP), a conversion must occur. Most payment platforms do not offer the mid-market rate—the "real" exchange rate you see on Google or financial news sites. Instead, they offer a less favorable rate. The difference between their rate and the mid-market rate is their profit, and it functions as a hidden fee. For example, if the mid-market rate is 1 USD = 7.30 CNY, a payment processor might offer you a rate of 1 USD = 7.05 CNY. On a $300 purchase, this seemingly small difference results in you paying more in your local currency to meet the CNY price.

Identifying Agent Service Fees

Beyond currency conversion, some payment methods trigger additional service fees from the shopping agent. Agents often pass on the percentage-based fee charged to them by processors like PayPal. This is why you might see a "PayPal fee" of 2-4% added to your transaction total. These fees are separate from any currency conversion costs and should be factored into your calculations when comparing the total cost of different payment options.

How Do You Compare Different Payment Options?

Evaluating payment methods requires looking at speed, convenience, and, most importantly, the combined impact of exchange rates and explicit fees. What appears easiest is not always cheapest. Here is a breakdown of the most common options.

Paying Directly with PayPal

PayPal is often the default choice for its simplicity and buyer protection. However, this convenience comes at a premium. PayPal is known for its less-than-favorable currency exchange rates, which can be several percentage points worse than the mid-market rate. Additionally, many agents will add a service fee to offset the high fees PayPal charges them as a merchant. While it's a secure and straightforward option, it is consistently one of the most expensive ways to fund your agent balance or pay for a haul.

Using a Credit/Debit Card

Paying directly with a credit or debit card can sometimes be more economical than PayPal, but it depends entirely on your card issuer. Many standard credit cards charge a foreign transaction fee, typically around 3% of the purchase amount. This can negate any potential savings from a better exchange rate. However, if you possess a travel-focused credit card or a modern fintech debit card that has *no foreign transaction fees*, this can be a viable option. You are still subject to the exchange rate provided by Visa or Mastercard, which is generally better than PayPal's but not always as good as the mid-market rate.

Leveraging Third-Party Services like Wise

For savvy shoppers, third-party services like Wise are the gold standard for cost-effectiveness. These platforms are designed for international money transfers and operate on a different model. They offer the mid-market exchange rate and charge a small, transparent, and upfront fee. The process involves sending money from your bank account to Wise, which then transfers the funds in CNY to your agent's bank account (often via Alipay). While it requires a few extra steps compared to PayPal, the savings from the superior exchange rate and low fees are substantial, especially for transactions over $100.

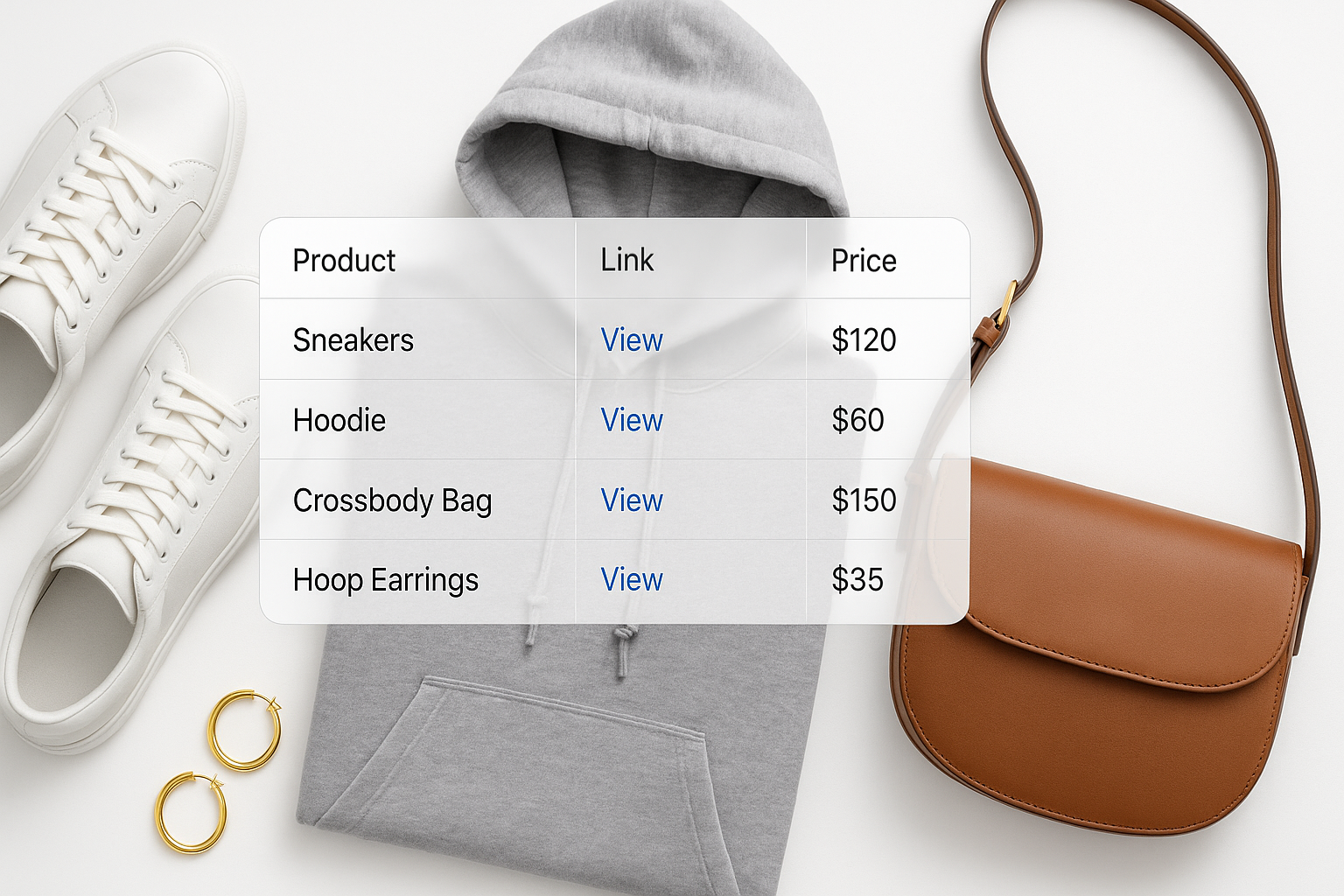

| Payment Method | Ease of Use | Exchange Rate | Associated Fees | Overall Cost-Effectiveness |

|---|---|---|---|---|

| PayPal | Very High | Poor | High (agent may add 2-4% service fee) | Low |

| Credit/Debit Card | High | Moderate | Moderate (potential 3% foreign transaction fee) | Moderate (only if no foreign transaction fee) |

| Wise (Third-Party) | Moderate | Excellent (Mid-Market Rate) | Low (small, transparent transfer fee) | Very High |

What is the Process for Using Wise to Fund Your Agent Account?

Using Wise to top up your agent balance is a straightforward procedure. First, you create an account on Wise. On your shopping agent's website, navigate to the "Top Up" or "Wallet" section and select the option for a bank transfer or Alipay transfer. The agent will provide their payment details, including an Alipay account number or bank information and a unique transfer reference code that links the payment to your account.

Next, you initiate a new transfer within your Wise account. You will enter the amount you wish to send in CNY, and Wise will show you exactly how much it will cost in your local currency, including their low fee. You then input the agent's payment details and your unique reference code into the appropriate fields. Finally, you fund the transfer from your own bank account. The funds typically arrive in your agent's account within minutes to a few hours, ready to be used for purchases and shipping.

Should You Top Up Your Agent Balance or Pay Per Transaction?

Topping up your agent balance in a larger, single transaction is almost always more cost-effective than paying for individual items or shipping separately. This is particularly true when using a service like Wise, where transfer fees can have a small fixed component. Sending one $500 transfer is cheaper than sending five $100 transfers. Furthermore, topping up a substantial amount means you lock in an exchange rate for all your upcoming purchases and shipping payments, protecting you from currency fluctuations. It streamlines the process, allowing for instant payment for items and shipping from your pre-funded balance without payment delays.

How Can You Minimize Shipping Costs to Maximize Savings?

Effective payment is only half the battle; the other half is aggressively managing shipping costs, which can easily exceed the cost of the items themselves. Once your items, found efficiently via the CNfans spreadsheet, arrive at the warehouse, you have several tools at your disposal to reduce the final shipping bill.

The Importance of Rehearsal Shipping

International shipping is priced based on either actual weight or volumetric weight (the amount of space a package occupies), whichever is greater. Agents initially provide a shipping estimate that is often higher than the final cost. Rehearsal shipping is a service where the agent professionally packs your items, weighs and measures the final parcel, and gives you a precise shipping cost. This allows you to pay the exact amount required and choose the most suitable shipping line based on accurate data, preventing overpayment and potential refund hassles.

Smart Packaging Choices

You can further reduce volumetric weight by instructing your agent on packaging. Requesting the removal of shoe boxes, for instance, can dramatically shrink the size and weight of your parcel. Other options like vacuum-sealing clothing and using simple, no-frills packaging instead of reinforced boxes (when item fragility allows) also contribute to significant savings. These simple instructions given before rehearsal shipping can lead to a much lower final invoice.

Are There Other Hidden Costs to Consider?

The final financial hurdle is customs and import duties. The value you declare for your parcel can determine whether you are charged taxes or duties by your country's customs agency. Researching your country's "de minimis" value—the threshold below which goods are not subject to import taxes—is crucial. Declaring a value that is realistic but below this threshold can help you avoid unexpected charges upon delivery. However, declaring an unrealistically low value can raise suspicion and lead to inspections or fines, so a balanced and informed approach is essential.

Putting It All Together: A Cost-Saving Checklist

Maximizing the value of your purchases is a systematic process. By following a clear set of steps, you can ensure you are paying the lowest possible total price for the high-quality items you have sourced.

1. Find the Best Item Price: Use the CNfans spreadsheet to locate the best-value products and sellers from the start.

2. Choose the Right Payment Method: Opt for a Wise transfer to top up your agent balance, avoiding high PayPal fees and poor exchange rates.

3. Top Up in Bulk: Fund your agent wallet with a single, larger transaction to minimize transfer fees and streamline payments.

4. Prepare for Shipping: Instruct your agent to remove unnecessary packaging like shoe boxes before packing.

5. Use Rehearsal Shipping: Get an accurate weight and volume measurement to pay the exact shipping cost and choose the best carrier.

6. Declare Smartly: Research your country's import thresholds and declare a reasonable value to minimize the risk of customs fees.

By integrating these financial strategies into your buying process, you move from being a simple shopper to a savvy importer, ensuring every dollar spent is used as efficiently as possible.