The best credit cards for CNfans spreadsheet transactions are those with no foreign transaction fees, robust rewards programs, and strong purchase protection. Top choices include the Capital One Venture Rewards Credit Card and the Chase Sapphire Preferred® Card, as they help you save money on international fees while earning valuable points on every purchase you make.

Why Does Your Choice of Credit Card Matter for CNfans Purchases?

When you're ready to check out your curated finds using the CNfans spreadsheet, the credit card you use is more than just a payment tool; it's a financial strategy. Since CNfans facilitates purchases from international merchants, transactions are often processed in a foreign currency or by an overseas entity. Using a standard domestic credit card can lead to unexpected charges that eat into your savings.

The primary culprit is the foreign transaction fee (FTF), a surcharge levied by many banks on purchases made outside your home country. This fee typically ranges from 1% to 3% of the total transaction amount. On a $500 haul, that could be an extra $15 in fees alone. A carefully selected credit card eliminates this fee entirely. Furthermore, the right card can earn you valuable rewards—like points, miles, or cashback—on every dollar you spend, effectively giving you a discount on your purchases. Security features like purchase protection and fraud alerts add another layer of confidence, ensuring your shopping experience is both economical and secure.

Which Credit Cards Offer the Best Value for CNfans Users?

Selecting a credit card that aligns with your international shopping habits is crucial. The following cards are highly regarded for their combination of no foreign transaction fees, excellent rewards structures, and strong consumer protections, making them ideal companions for your CNfans transactions.

Capital One Venture Rewards Credit Card: Why is it a top pick for international shoppers?

The Capital One Venture Rewards card is a powerhouse for anyone frequently making international purchases. Its standout feature is the straightforward, unlimited 2x miles per dollar on every single purchase, with no special categories to track. This means every item you add to your CNfans order, from sneakers to accessories, earns you a consistent rate of rewards.

Most importantly, this card has no foreign transaction fees, a non-negotiable feature for savvy CNfans users. The miles you accumulate are flexible and can be redeemed for statement credits to cover travel purchases, effectively turning your shopping hauls into future vacations. Its simplicity and strong earning potential make it a perennial favorite for cross-border e-commerce.

Chase Sapphire Preferred® Card: How do its travel rewards benefit you?

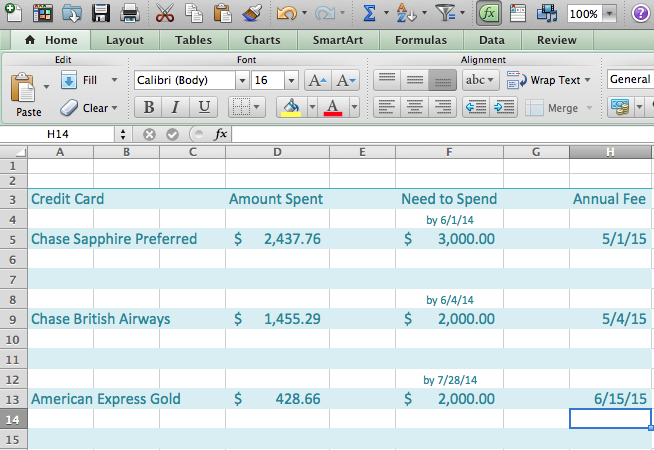

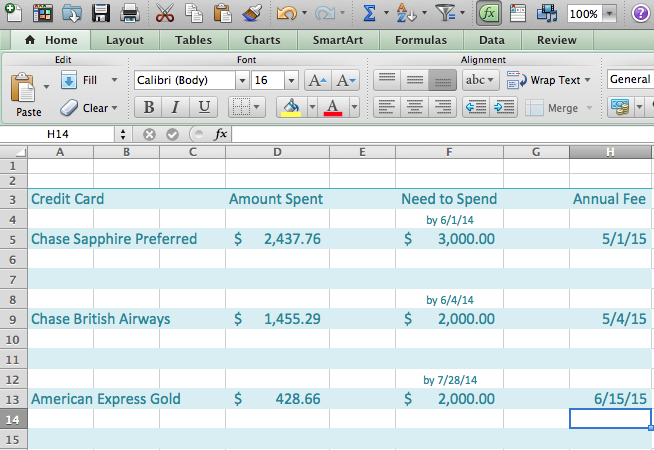

The Chase Sapphire Preferred® Card is another top-tier option, renowned for its valuable Ultimate Rewards® points. While it offers bonus points on travel and dining, it still provides a solid earning rate on all other purchases, including those made through CNfans. These points can be exceptionally valuable when redeemed for travel through the Chase portal or transferred to airline and hotel partners.

Like the Venture card, it charges no foreign transaction fees, saving you up to 3% on every order. What sets the Sapphire Preferred apart is its suite of premium benefits, including excellent trip cancellation/interruption insurance and purchase protection. This can provide peace of mind if there are any issues with your international shipment, making it a secure and rewarding choice for funding your CNfans balance.

Bank of America® Travel Rewards Credit Card: What makes this a simple, no-fee option?

For those who prefer simplicity and want to avoid an annual fee, the Bank of America® Travel Rewards credit card is an outstanding choice. It offers a flat 1.5 points per dollar spent on all purchases, with no limit to how much you can earn. These points can be easily redeemed as a statement credit to offset any travel or dining purchases, including the shipping fees associated with your CNfans orders.

Its primary appeal for CNfans shoppers is the combination of no annual fee and no foreign transaction fees. This makes it a completely cost-effective way to pay for your international goods. If you are a Bank of America customer with a qualifying account, you could earn up to a 75% rewards bonus through the Preferred Rewards program, significantly boosting your earning potential.

American Express® Gold Card: Is it ideal for earning rewards on global purchases?

The American Express® Gold Card excels at earning rewards on everyday spending, particularly at restaurants worldwide and at U.S. supermarkets. While its bonus categories may not directly apply to CNfans transactions, it remains a strong contender because it charges no foreign transaction fees. You will earn Membership Rewards® points on your CNfans purchases, which are highly flexible and can be transferred to a wide array of airline and hotel partners.

This card is best for users who can also take full advantage of its dining and other statement credits to offset the annual fee. The robust purchase protection and extended warranty benefits offered by American Express also add a valuable layer of security for your international orders, protecting your high-value items.

Discover it® Miles: How does its cashback match work for CNfans hauls?

The Discover it® Miles card is a unique and compelling option, especially for new cardholders. It functions as a straightforward travel rewards card, offering an unlimited 1.5 miles per dollar on every purchase. What makes it truly special is the Unlimited Cashback Match feature: Discover will automatically match all the miles you've earned at the end of your first year. This effectively turns it into a 3% rewards card for the first 12 months.

With no foreign transaction fees and no annual fee, it's a risk-free choice for your CNfans payments. Your miles can be redeemed as a statement credit for travel purchases or converted directly to cash at a 1:1 ratio. This flexibility, combined with the powerful first-year match, can yield significant savings and rewards on your international shopping.

How Do These Top Credit Cards Compare for CNfans Transactions?

Choosing the right card depends on your spending habits and financial goals. This table breaks down the key features of each recommended card to help you make an informed decision for your next CNfans order.

| Feature | Capital One Venture | Chase Sapphire Preferred® | BofA Travel Rewards | Amex Gold |

|---|---|---|---|---|

| Foreign Transaction Fee | None | None | None | None |

| Rewards on CNfans | 2x Miles per dollar | 1x Point per dollar | 1.5x Points per dollar | 1x Point per dollar |

| Annual Fee | Typically ~$95 | Typically ~$95 | $0 | Typically ~$250 |

| Primary Advantage | Simple, high flat-rate rewards | High-value, flexible points | No annual fee, simple rewards | Strong purchase protections |

What Key Features Should You Look For in a Credit Card for CNfans?

When evaluating credit cards for your CNfans purchases, focus on features that directly impact your bottom line and provide security. Prioritizing these elements will ensure you have the best possible payment experience.

No Foreign Transaction Fees: How much can you save?

This is the most critical feature. A card with no foreign transaction fees is essential. These fees, usually around 3%, are applied to every purchase processed outside your home country. If you spend $1,500 a year through CNfans, a 3% fee would cost you an extra $45 for nothing in return. Choosing a card that waives this fee means that money stays in your pocket or goes toward your next purchase.

Competitive Reward Programs: Are you earning points or cashback?

A good rewards program turns your spending into a benefit. Look for cards that offer a solid, flat-rate return on all purchases, as agent-based shopping might not fall into common bonus categories like "travel" or "groceries." A card earning 1.5% to 2% back on every dollar spent provides a consistent and valuable return. Whether you prefer flexible travel points, miles, or straightforward cashback, ensure the rewards structure is easy to understand and redeem.

Strong Purchase Protection: What happens if your order goes wrong?

International shipping comes with inherent risks, such as damaged items or lost packages. Credit cards with strong purchase protection can be a lifesaver. This benefit can cover you for a set period (e.g., 90-120 days) if an eligible item you bought is damaged or stolen. Similarly, extended warranty benefits can add extra coverage to your purchases. These protections provide a crucial safety net that goes beyond the policies of the shopping agent or seller.

Global Acceptance and Security: Will your transaction be smooth and safe?

Ensure the card you choose, whether it's a Visa, Mastercard, or American Express, is widely accepted by international payment processors. All the cards recommended here have excellent global acceptance. Additionally, look for cards with strong fraud protection, including zero liability for unauthorized charges and real-time transaction alerts. This ensures that you can shop with confidence, knowing your account is monitored for suspicious activity.

How Can You Maximize Your Rewards and Savings on CNfans?

Simply having the right card is only half the battle. To truly maximize your benefits, use your card strategically. Always use your no-FTF card for every single CNfans transaction, including topping up your account balance and paying for international shipping. This ensures you're earning rewards on the total cost of your haul.

Keep an eye out for any sign-up bonuses when you first get a new card. Meeting the minimum spending requirement for a new card by timing it with a large CNfans purchase can earn you a substantial lump sum of points or cashback. Also, be sure to pay your statement balance in full each month. The interest charged on a carried balance will quickly negate any rewards you’ve earned.

What Are the Common Pitfalls to Avoid When Paying on CNfans?

One major pitfall to watch for is Dynamic Currency Conversion (DCC). This is when an international merchant offers to convert the transaction to your home currency at the point of sale. While it may seem convenient, the exchange rate used is almost always unfavorable and includes a hidden markup. Always choose to pay in the local currency (e.g., Chinese Yuan - CNY) and let your credit card network (Visa, Mastercard) handle the conversion. Their rates are far more competitive.

Another pitfall is using a debit card instead of a credit card. Debit cards often come with foreign transaction fees and lack the robust fraud and purchase protections that credit cards offer. In case of a dispute or a lost package, it is much more difficult to recover funds from a debit card transaction. Stick to a credit card for better security and recourse.