A 2025 savings plan is a structured strategy to help you achieve your financial goals, like saving for a major purchase, by breaking them down into manageable steps. Using a dedicated tool like the Cnfans spreadsheet Goal Tracker simplifies this process by allowing you to set clear targets, track your progress, and visualize your success. This approach transforms a distant wish into an attainable objective, putting you in control of your financial future and bringing your dream purchases within reach.

Table of Contents

- Why is a 2025 Financial Goal Plan Essential?

- Step 1: Defining Your 2025 Savings Ambitions

- Step 2: Crafting Your Personal Budget

- Step 3: Choosing the Right Tools to Track Progress

- Step 4: Implementing Actionable Savings Strategies

- Advanced Techniques for Staying on Track

- Putting It All Together: Your 2025 Savings Calendar

- Frequently Asked Questions about Savings Plans

Why is a 2025 Financial Goal Plan Essential?

Embarking on a new year without a financial plan is like setting sail without a map. A well-defined savings plan for 2025 provides direction and purpose for your money. It shifts your mindset from passive wishing to active achieving. By establishing clear targets, you give every dollar a mission, which is crucial for making significant purchases, such as a large fashion or electronics "haul," a reality rather than a daydream. This structured approach is the bedrock of financial discipline.

The psychological benefits are just as significant as the financial ones. Tracking your progress towards a goal creates a powerful feedback loop of motivation. Each time you update your savings and see the needle move closer to your target, it reinforces your commitment and makes it easier to resist impulse buys. This process builds confidence and places you firmly in the driver's seat of your financial life, reducing the anxiety that often comes with unstructured spending and vague financial goals.

Step 1: Defining Your 2025 Savings Ambitions

What is Your Ultimate "Haul" Goal?

Specificity is your greatest ally. Instead of a vague goal like "save for a new haul," you must define exactly what that entails. Which specific items are you targeting? What are their estimated prices? Create a detailed wishlist. This clarity is the first step in the S.M.A.R.T. goal-setting framework.

- Specific: Pinpoint the exact items—the jacket, the sneakers, the tech accessory.

- Measurable: Assign a realistic dollar value to your goal.

- Achievable: Ensure the target is reachable within your financial reality for 2025.

- Relevant: The goal must genuinely matter to you, providing the motivation to stick with the plan.

- Time-bound: Set a deadline, for instance, "Save $1,500 by October 2025."

How to Calculate Your Total Savings Target

Calculating the true cost of an international haul involves more than just the price tags of the items. To avoid falling short, your savings target must be comprehensive. Start by listing the cost of each individual item you plan to purchase. Next, factor in the agent's service fees, which are typically a small percentage of the item's cost. The most critical and often underestimated component is international shipping. Research typical shipping rates for the weight you anticipate and add a buffer of 15-20% to your total estimate. This contingency plan accounts for price fluctuations, currency conversion changes, and unexpected shipping costs, ensuring you are fully prepared.

Step 2: Crafting Your Personal Budget

Analyzing Your Income and Expenses

A budget is the engine of your savings plan. To build one, you must first understand where your money is coming from and where it is going. Begin by calculating your total monthly net income (after taxes). Then, meticulously track your expenses for a month. Categorize them into fixed costs (rent, subscriptions, loan payments) and variable costs (groceries, entertainment, shopping). This analysis will reveal exactly where your money is being allocated and identify potential areas where you can cut back to redirect funds toward your savings goal.

Popular Budgeting Methods for Savvy Shoppers

Once you understand your cash flow, you can apply a budgeting method. The 50/30/20 rule is an excellent starting point for its simplicity: allocate 50% of your income to needs, 30% to wants, and 20% to savings. For those saving for a specific, large purchase, you might adjust this to 50/20/30, prioritizing your savings goal over discretionary wants.

For more granular control, the zero-based budgeting method is highly effective. With this technique, every single dollar of your income is assigned a specific job—whether it's paying a bill, buying groceries, or going into your "haul fund." This ensures no money is wasted and that your savings goal is treated as a non-negotiable expense.

Step 3: Choosing the Right Tools to Track Progress

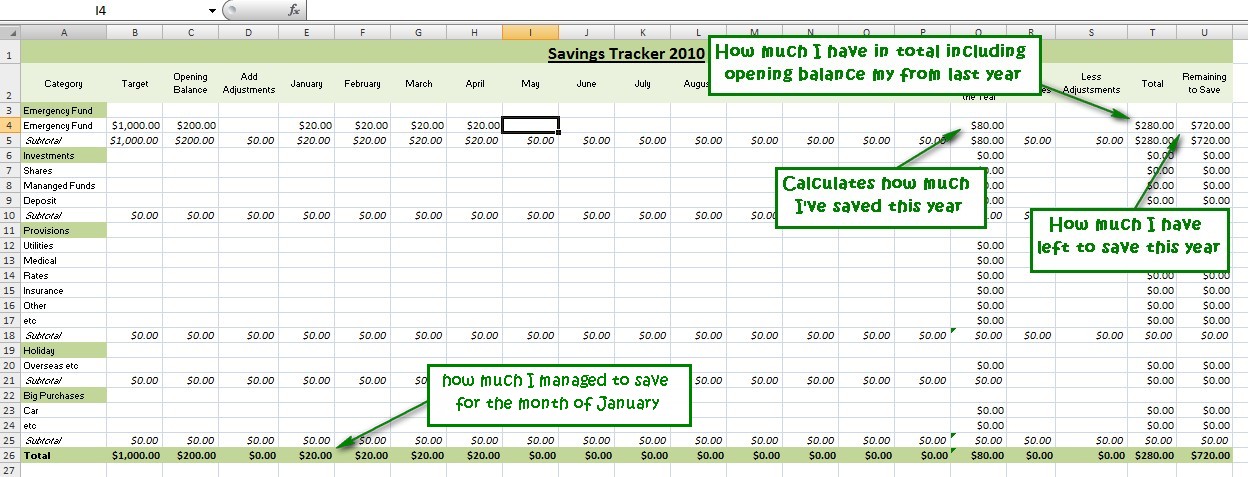

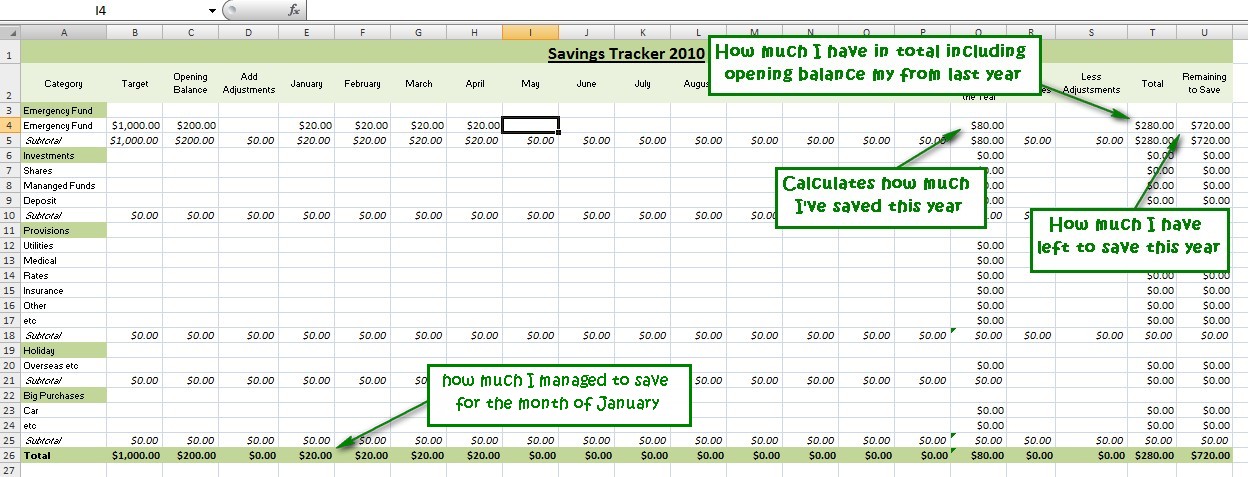

The Power of a Dedicated Spreadsheet

While mental accounting or basic notes apps might seem sufficient, they lack the structure and functionality needed for serious goal tracking. A dedicated spreadsheet is a far superior tool. It allows you to create formulas that automatically calculate your progress, visualize your savings with charts and graphs, and keep all relevant information—item lists, costs, savings entries, and timelines—in one organized location. This centralized command center provides a clear and accurate picture of your journey, making it easier to stay organized and motivated.

Introducing the Cnfans spreadsheet Goal Tracker

While a generic spreadsheet is good, a specialized one is better. The Cnfans spreadsheet Goal Tracker is purpose-built for individuals saving for hauls. It's designed with the understanding that you're tracking not just money, but progress towards a collection of specific items. The tracker includes features to:

- List desired items and their costs.

- Set a total savings goal, including estimated shipping and fees.

- Log each deposit into your savings, automatically updating your progress.

- Visualize your journey with dynamic charts that show how much you've saved and how much is left.

This tool transforms the abstract concept of "saving money" into the tangible and exciting process of building your next haul, piece by piece. It's crafted for the community and understands the unique financial journey of an international shopper.

Step 4: Implementing Actionable Savings Strategies

How Can You Automate Your Savings?

The most effective savings strategy is one you don't have to think about. Automation is the key to consistency. Set up an automatic transfer from your checking account to a separate, high-yield savings account each payday. This "pay yourself first" approach treats your savings goal as a mandatory bill. By moving the money before you have a chance to spend it, you eliminate the need for willpower and ensure steady progress toward your 2025 objective. Even a small, recurring amount adds up significantly over a year.

Finding Extra Cash: The "Haul Fund" Boost

To accelerate your progress, actively look for ways to generate extra cash specifically for your savings goal. Start by decluttering your closet and selling clothes or other items you no longer use on platforms like Depop, Grailed, or Facebook Marketplace. Consider a small side hustle related to your skills, such as freelance writing, graphic design, or even online surveys. Finally, scrutinize your variable expenses. Could you cut back on dining out, streaming services, or daily coffee purchases? Redirecting the money saved from these small cuts can give your "haul fund" a substantial boost.

Advanced Techniques for Staying on Track

What are Effective Money-Saving Challenges?

To gamify your savings and keep things interesting, incorporate a money-saving challenge into your 2025 plan. The 52-week challenge is a popular choice, where you save $1 in week one, $2 in week two, and so on, resulting in $1,378 saved by the end of the year. Alternatively, create your own challenge. A "no-spend month" where you only purchase absolute necessities can free up a significant chunk of cash. Or, try a "rounding up" challenge, where you round every purchase up to the nearest dollar and transfer the difference to your savings.

Visualizing Success and Overcoming Setbacks

Maintaining motivation over a long period requires more than just discipline; it requires inspiration. Use the charts and graphs in your goal tracker as a visual reminder of how far you've come. Create a mood board—digital or physical—of the items you're saving for. Setbacks are inevitable; you may have an unexpected expense or miss a savings target. The key is not to let it derail you. Acknowledge the setback, adjust your plan if necessary, and refocus on the very next step. One off-month doesn't negate the progress you've already made.

Putting It All Together: Your 2025 Savings Calendar

A tangible schedule can make your goal feel more concrete. Below is a hypothetical example of a plan to save $1,200 by September 2025. You can adapt this structure within your own goal tracker.

| Month (2025) | Monthly Savings Goal | Cumulative Savings |

|---|---|---|

| January | $135 | $135 |

| February | $135 | $270 |

| March | $135 | $405 |

| April | $135 | $540 |

| May | $135 | $675 |

| June | $135 | $810 |

| July | $135 | $945 |

| August | $135 | $1,080 |

| September | $120 | $1,200 (Goal Reached!) |

Frequently Asked Questions about Savings Plans

How much should I realistically save each month?

There is no single answer. The ideal amount depends entirely on your income, expenses, and the size of your savings goal. After analyzing your budget, determine a realistic figure that you can consistently contribute without jeopardizing your financial stability. For many, aiming to save 15-20% of their post-tax income is a solid target, but even starting with 5% is a great first step.

What if my income is irregular?

If you have a variable income from freelancing or gig work, budgeting based on a percentage is highly effective. Commit to saving a specific percentage (e.g., 25%) of every paycheck, no matter the size. During high-income months, you will save more, creating a buffer for leaner months. It's also wise to calculate your average monthly income over the past year and create a baseline budget from that figure.

Is it better to save a little bit consistently or large chunks occasionally?

Consistency almost always wins. Saving small, regular amounts builds a powerful habit and leverages the principle of automation. It creates steady, predictable progress. While saving large, infrequent chunks can also work, it often requires more discipline and can be less reliable, as unexpected expenses can easily derail your intention to save a future windfall.