A stock investment record sheet is an essential tool for investors to meticulously track their portfolio's performance, manage transactions, and make informed financial decisions. The Cnfans spreadsheet 2025 Stock Investment Record Sheet streamlines this process by offering a powerful, automated, and user-friendly template designed to provide a comprehensive view of your investments, from individual stock performance to overall portfolio health and dividend income.

Table of Contents

- Why Is Meticulous Stock Investment Tracking Non-Negotiable?

- What Essential Data Should Your Investment Record Sheet Capture?

- Introducing the Cnfans 2025 Stock Investment Record Sheet

- How Does the Cnfans Spreadsheet Automate Performance Analysis?

- Beyond the Basics: Advanced Features for Savvy Investors

- Comparing DIY Spreadsheets vs. the Cnfans Professional Template

- Who Can Benefit from This Investment Tracking Tool?

- Getting Started with Your 2025 Stock Investment Record

- Frequently Asked Questions about Investment Tracking

Why Is Meticulous Stock Investment Tracking Non-Negotiable?

Maintaining a detailed record of your stock investments is fundamental to successful portfolio management. Without a clear system, you are essentially navigating the market blindfolded. Proper tracking moves you from guessing to knowing, transforming raw data into actionable intelligence and providing a solid foundation for your financial strategy.

Gaining Clarity and Control Over Your Assets

Do you know the exact cost basis of your holdings or your portfolio's true diversification? An investment record sheet answers these questions instantly. It consolidates all your scattered investment information—from different brokers and accounts—into one centralized location. This unified view gives you unparalleled clarity on where your money is, how it's allocated, and which assets are driving your growth. This control is the first step toward optimizing your portfolio and aligning it with your financial goals.

Making Data-Driven Investment Decisions

Emotional decision-making is the enemy of profitable investing. A well-maintained record sheet provides objective data to guide your choices. By analyzing metrics such as individual stock performance, sector exposure, and realized gains, you can identify underperforming assets that may need to be sold and recognize strong performers where you might increase your position. Instead of reacting to market noise, you can act based on your own performance data, leading to more strategic and less impulsive trades.

Simplifying Tax Season with Organized Records

Tax time can be a significant source of stress for investors. Calculating capital gains and losses requires precise information, including purchase dates, sale dates, costs, and proceeds. A dedicated stock investment record sheet, especially one that differentiates between short-term and long-term gains, makes tax preparation incredibly straightforward. Having all the necessary data organized and ready saves you time, reduces the risk of costly errors, and ensures you can accurately report your investment income and losses to tax authorities.

What Essential Data Should Your Investment Record Sheet Capture?

An effective investment tracker is built on a framework of critical data points. Capturing the right information is what enables powerful analysis and insightful reporting. A comprehensive sheet should be structured to record transactional details, performance metrics, and income from dividends.

Transactional Details: The Foundation of Your Record

Every calculation begins with the basic transaction data. This is the bedrock of your investment log, and accuracy here is paramount. Your sheet must have fields for:

- Ticker Symbol: The unique identifier for the stock.

- Company Name: For easy reference.

- Transaction Type: Buy or Sell.

- Date of Transaction: Crucial for calculating holding periods and capital gains.

- Number of Shares: The quantity of stock traded.

- Price Per Share: The price at which the transaction was executed.

- Commission/Fees: Any costs associated with the trade, which should be factored into your cost basis.

- Total Cost/Proceeds: The total amount spent or received (Shares x Price ± Fees).

Performance Metrics: Gauging Your Success

Once transactional data is logged, your sheet should automatically calculate key performance indicators (KPIs) to show you how your investments are faring. These metrics transform raw data into a clear performance narrative.

Essential metrics include the current market price, market value (Current Price x Shares), unrealized gain/loss (the profit or loss on paper for assets you still hold), and realized gain/loss (the profit or loss locked in from assets you have sold). Tracking these separately is vital for understanding both your current position and your historical performance.

Dividend Tracking: Monitoring Your Passive Income

For many investors, dividends are a critical component of total return. A robust record sheet should dedicate a section to tracking this income stream. Key data points include the dividend per share, payment date, and total dividend received for each holding. Summing this up provides a clear picture of your portfolio's cash flow and helps you evaluate the income-generating power of your assets.

Introducing the Cnfans 2025 Stock Investment Record Sheet

While a DIY spreadsheet is a start, the Cnfans 2025 Stock Investment Record Sheet elevates your tracking from a simple logbook to a dynamic, professional-grade portfolio management system. Created by a team of finance and data analysis experts, this template is engineered to save you time, eliminate manual calculation errors, and deliver insights that a basic sheet cannot.

Designed for Clarity and Intuitive Use

The first thing you will notice is the clean, professional design. The Cnfans spreadsheet is structured for intuitive data entry. You only need to input your basic transaction details in a designated log. All complex calculations—from portfolio allocation to unrealized gains and dividend yields—are handled automatically. There are no complicated formulas to write or debug. It’s a true plug-and-play solution designed for investors, not spreadsheet gurus.

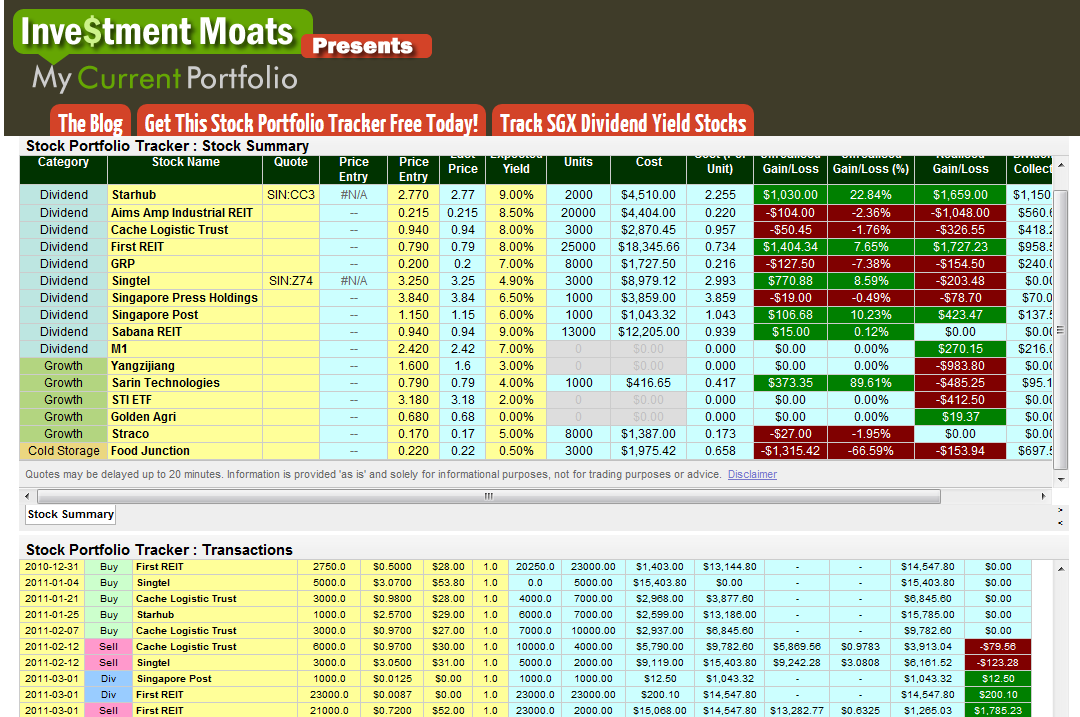

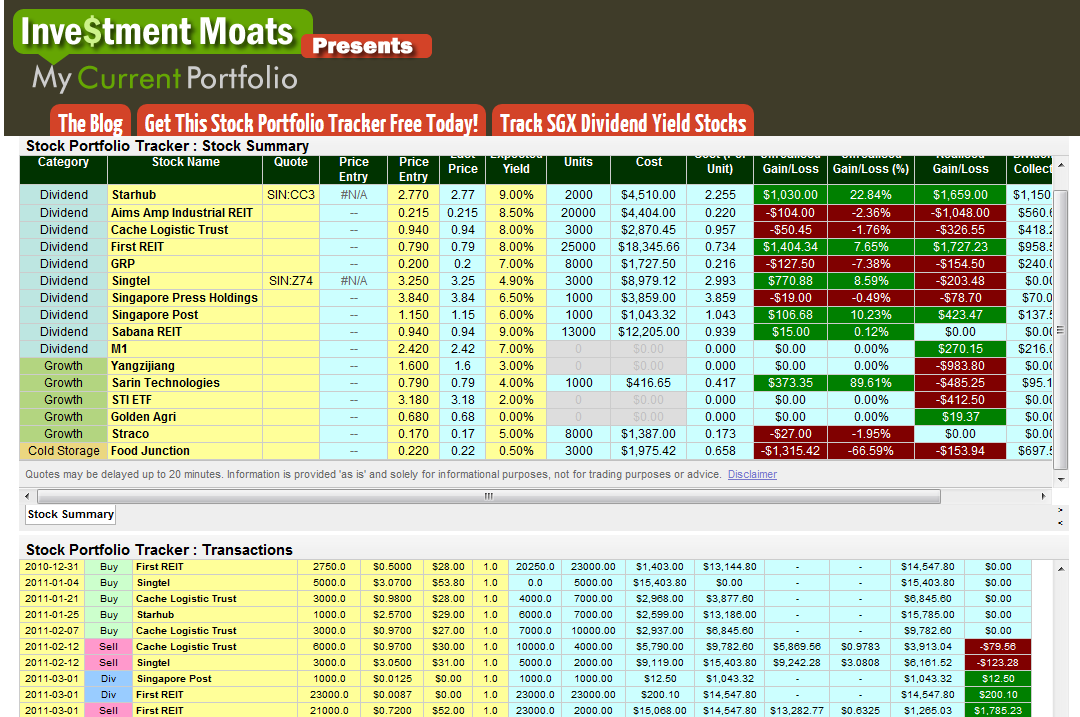

Automated Dashboards for Instant Insights

The true power of the Cnfans template lies in its automated dashboard. This central hub visualizes your entire portfolio's health on a single screen. With dynamic charts and summary tables, you can see your total portfolio value, overall profit/loss, asset allocation by sector, and top-performing stocks at a glance. This high-level view is indispensable for quick check-ins and strategic planning, providing immediate answers to your most pressing investment questions.

How Does the Cnfans Spreadsheet Automate Performance Analysis?

The key differentiator of a premium template is automation. The Cnfans spreadsheet leverages powerful, pre-built functions to perform complex analyses instantly, freeing you to focus on strategy rather than number-crunching.

Real-Time Portfolio Valuation

What is your portfolio worth right now? The Cnfans sheet can connect to live market data to pull current stock prices automatically. This means your portfolio's market value, as well as unrealized gains and losses for each holding, are always up-to-date. This feature provides a real-time pulse on your investments, which is critical in a fast-moving market.

Calculating Realized vs. Unrealized Gains/Losses

The spreadsheet intelligently distinguishes between open and closed positions. When you log a "Buy" transaction, it tracks the unrealized performance over time. When you log a "Sell" for that same stock, it automatically calculates the realized gain or loss from that trade and moves it to a historical performance summary. This automated segregation is vital for accurate performance assessment and tax reporting.

Visualizing Performance with Charts and Graphs

Data is more impactful when visualized. The Cnfans template includes a variety of pre-configured charts to help you interpret your portfolio's performance. Pie charts break down your allocation by industry or asset class, while bar charts can display the realized gains from your most profitable trades. These visual aids make it easy to spot trends, identify concentration risks, and understand the composition of your portfolio without sifting through rows of numbers.

Beyond the Basics: Advanced Features for Savvy Investors

A superior investment tracker goes beyond simple profit and loss calculations. The Cnfans 2025 sheet incorporates advanced functionalities designed to give you a deeper, more strategic understanding of your investments.

Sector and Asset Allocation Analysis

Are you overexposed to the technology sector? Is your portfolio diversified enough to withstand a downturn in a specific industry? The Cnfans spreadsheet automatically categorizes your holdings by sector and presents a clear breakdown of your portfolio's allocation. This feature is crucial for risk management, helping you ensure your investments are spread appropriately across different parts of a market.

Comprehensive Dividend Income Summary

The dedicated dividend dashboard provides more than just a running total. It projects your annual dividend income based on current holdings, tracks your yield on cost, and displays monthly dividend income. This allows you to monitor and forecast your passive income stream with precision, a key feature for income-focused and long-term investors.

Setting and Tracking Investment Goals

What are you investing for? The Cnfans sheet allows you to set financial goals—such as a target portfolio value or a specific annual income from dividends—and track your progress toward them. This feature adds a motivational element to your investment journey, connecting your day-to-day tracking activities to your long-term aspirations.

Comparing DIY Spreadsheets vs. the Cnfans Professional Template

For investors considering how to track their portfolio, the choice often comes down to building a spreadsheet from scratch or using a professional template. While a DIY approach is possible, it comes with significant trade-offs.

| Feature | DIY Spreadsheet | Cnfans 2025 Investment Sheet |

|---|---|---|

| Setup Time & Effort | High; requires hours or days to design, build formulas, and debug. | Minimal; ready to use immediately after download. Just enter your transactions. |

| Formulas & Automation | Manual creation required. Prone to errors (e.g., incorrect cell references). | Fully automated. All calculations, charts, and summaries are pre-built and protected. |

| Visual Dashboard | Requires advanced skills to create effective and dynamic charts. | Includes a professional, interactive dashboard for at-a-glance analysis. |

| Advanced Features | Difficult to implement (e.g., live price data, dividend projections). | Built-in features for sector analysis, dividend tracking, and goal setting. |

| Reliability & Support | No support; you are responsible for all troubleshooting and updates. | Professionally developed and tested for accuracy, with customer support available. |

Ultimately, the Cnfans template provides a robust, error-free, and feature-rich solution out of the box. It represents an investment in accuracy and time-saving, allowing you to act like a portfolio manager, not a spreadsheet developer.

Who Can Benefit from This Investment Tracking Tool?

The Cnfans 2025 Stock Investment Record Sheet is a versatile tool designed to add value for investors at every level of experience. Its intuitive design and powerful features cater to a wide range of needs and strategies.

For the Beginner Investor

If you are new to investing, establishing good habits from the start is crucial. This spreadsheet demystifies portfolio tracking. Instead of being intimidated by financial metrics, you can easily log your first few trades and immediately see their performance. It serves as an excellent educational tool, helping you understand concepts like cost basis, unrealized gains, and dividend yield in a practical way.

For the Experienced Trader

Active traders who execute frequent transactions need a system that is both fast and powerful. The streamlined data entry and automated calculations allow for quick logging of trades. The real-time valuation and detailed performance analysis help active investors monitor positions closely, evaluate trading strategies, and prepare for tax season with an accurate record of short-term capital gains.

For the Long-Term 'Buy and Hold' Strategist

Long-term investors focused on wealth accumulation will find immense value in the dividend tracking and portfolio allocation features. You can monitor the compounding growth of your investments over years, track your passive income stream, and ensure your portfolio remains balanced and aligned with your long-term risk tolerance. The sheet provides the macro-level view needed for strategic, generational wealth building.

Getting Started with Your 2025 Stock Investment Record

Implementing the Cnfans spreadsheet into your investment routine is a simple and straightforward process. A few initial steps will set you up for long-term success in managing your portfolio.

Simple Steps to Set Up Your Portfolio

Once you have the template, begin by gathering your transaction history from your brokerage account(s). Start by entering all your current open positions in the transaction log. For each, you will need the purchase date, ticker, number of shares, and cost basis. Afterward, you can continue by logging all new buy or sell transactions as they occur. The automated dashboard will populate instantly, giving you an immediate, comprehensive view of your portfolio.

Tips for Maintaining Accurate Records

Consistency is key to leveraging the full power of your investment tracker. Make it a habit to log new trades as soon as they are executed. Set a recurring time—perhaps weekly or monthly—to review your dashboard, check your allocations, and analyze performance. This regular engagement ensures your data remains current and helps you stay connected to your investment strategy.

Frequently Asked Questions about Investment Tracking

What is the difference between realized and unrealized gains?

An unrealized gain is a potential profit on an asset you still own. It becomes a realized gain only when you sell the asset for more than your cost basis. A quality tracker, like the Cnfans sheet, calculates and displays these two metrics separately, as they have different implications for your net worth and tax liability.

How often should I update my investment record sheet?

For maximum accuracy and benefit, it is best practice to log a transaction immediately after you buy or sell a stock. If you have the automated live-price feature, your portfolio value will update on its own. For a general review, checking in weekly or monthly is a good cadence for most investors.

Can this spreadsheet track investments from multiple brokerage accounts?

Yes. The Cnfans spreadsheet is designed to be a central repository for all your stock investments. You can log transactions from any number of different brokerage accounts. Simply enter each transaction into the log; the sheet will aggregate the data to give you a total portfolio view, regardless of where the assets are held.