The Cnfans spreadsheet 2025 Loan Calculator Template is a powerful, pre-built financial tool designed to simplify complex loan calculations. It allows users to input loan variables like principal, interest rate, and term to instantly see their monthly payment, total interest paid, and a full amortization schedule, empowering them to make smarter borrowing decisions and gain complete control over their debt management strategy.

Table of Contents

- What Exactly is a Loan Calculator Spreadsheet?

- Why is Using a Dedicated Loan Calculator Template a Smart Financial Move?

- A Deep Dive into the Cnfans 2025 Loan Calculator Template's Features

- How to Effectively Use the Cnfans Loan Calculator

- Which Loan Scenarios Can You Analyze with This Template?

- How Can You Compare Different Loan Offers Side-by-Side?

- What is the Strategic Advantage of Planning for Extra Payments?

- Understanding Key Loan Terminology

- How is the Cnfans Template Superior to a Basic Spreadsheet?

- Who Can Benefit Most from This Financial Tool?

What Exactly is a Loan Calculator Spreadsheet?

A loan calculator spreadsheet is a specialized document crafted to perform financial computations related to borrowing. At its heart, it is a tool that takes the guesswork out of understanding loan obligations. Instead of manually wrestling with complex formulas, a user can input a few key pieces of information—the amount borrowed, the interest rate, and the repayment period—to receive instant, accurate results about their financial commitment.

The Core Function: Demystifying Loan Repayments

The primary function of any loan calculator is to determine the fixed monthly payment. This figure is crucial for budgeting and financial planning. The calculation considers how the interest accrues over the life of the loan and ensures that the principal is fully paid off by the end of the term. A well-designed spreadsheet presents this information clearly, providing an immediate answer to the fundamental question: "How much will this loan cost me each month?"

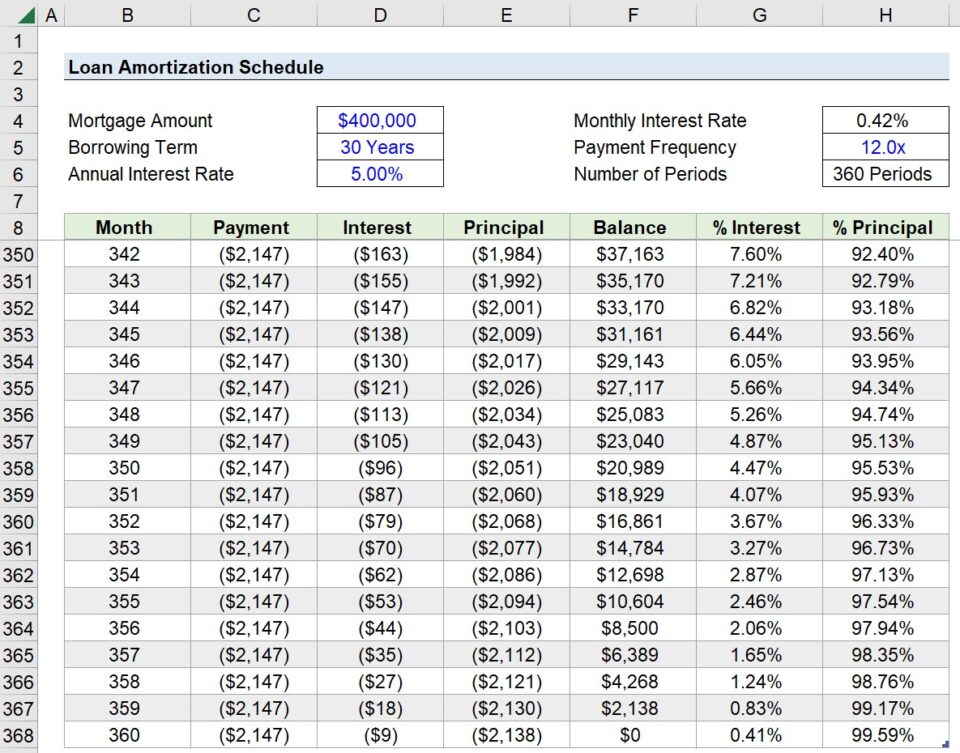

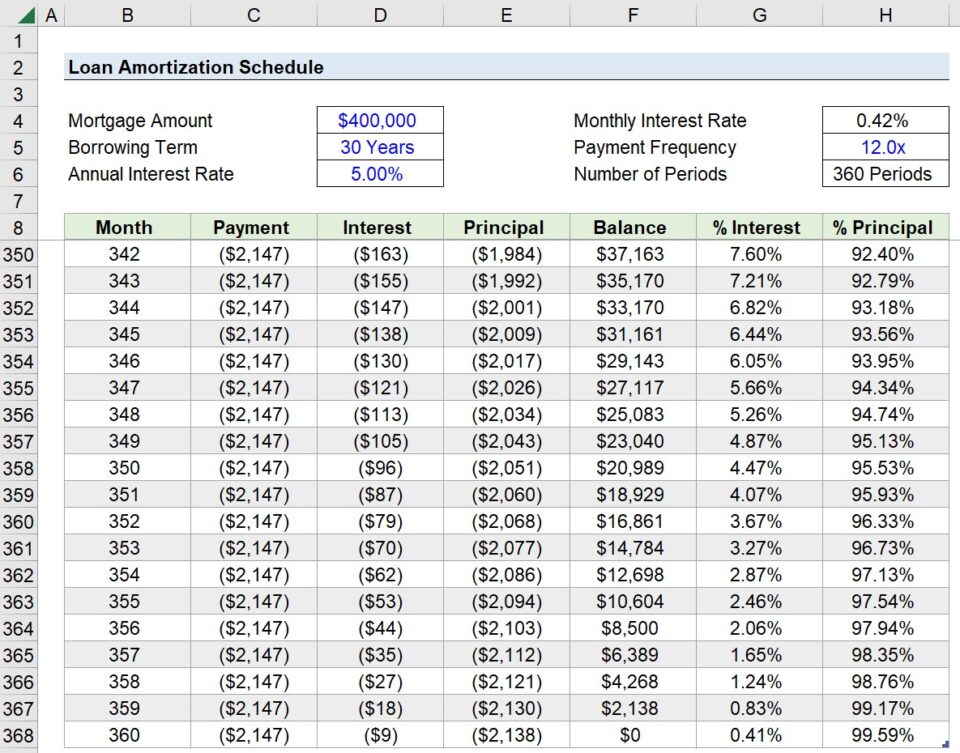

Beyond Simple Calculations: The Amortization Schedule

A truly powerful loan calculator does more than just calculate the monthly payment. It provides a full amortization schedule. This is a detailed, payment-by-payment breakdown of the entire loan. For each payment, the schedule shows precisely how much money is allocated toward paying down the principal (the amount you borrowed) and how much is going toward interest (the cost of borrowing). This transparency is vital for understanding the true cost of a loan over time.

Why is Using a Dedicated Loan Calculator Template a Smart Financial Move?

Opting for a professionally designed template over a manual calculation or a basic online tool offers significant advantages. It transforms a potentially confusing financial task into a streamlined, insightful process, giving you a tangible edge in managing your personal or business finances.

Gaining Clarity and Control Over Debt

Debt can feel overwhelming, but knowledge is the key to control. A dedicated template demystifies the numbers, breaking them down into an understandable format. By seeing the complete lifecycle of your loan—from the first payment to the last—you can shift from being a passive debtor to an active manager of your finances. This clarity helps reduce financial anxiety and builds confidence in your ability to handle your obligations.

Empowering Informed Decision-Making

When considering a loan, you are faced with multiple variables. What happens if the interest rate is 0.5% lower? How much faster could you pay off the loan by adding an extra $100 per month? A template allows for instant scenario analysis. You can tweak numbers and immediately see the long-term consequences, enabling you to compare different loan offers accurately and choose the one that best aligns with your financial goals, saving you potentially thousands of dollars in interest.

A Deep Dive into the Cnfans 2025 Loan Calculator Template's Features

The Cnfans spreadsheet 2025 Loan Calculator Template is engineered not just for calculation, but for comprehension and strategy. It is packed with features that elevate it beyond a simple numbers tool into a comprehensive financial planning assistant.

Intuitive User Interface for Effortless Data Entry

CNFans templates are renowned for their clean and user-friendly design. The loan calculator is no exception. Input fields are clearly labeled, and the dashboard is organized logically. You don't need to be a spreadsheet expert to use it. The design guides you through the process, ensuring you can input your data quickly and without confusion, making financial analysis accessible to everyone.

Comprehensive and Dynamic Amortization Schedule

The template automatically generates a complete, payment-by-payment amortization schedule that updates in real-time as you adjust your loan variables. It clearly separates principal and interest for each payment, shows the remaining balance after each period, and calculates the cumulative interest paid. This level of detail is indispensable for true financial oversight.

Visualizing Your Debt Reduction Journey with Charts

Numbers on a page can be abstract. The Cnfans template includes dynamic charts and graphs that visually represent your loan data. You can see a pie chart breaking down your total payments into principal and interest or a line graph showing your loan balance decreasing over time. These visual aids make it easier to grasp the impact of your payments and stay motivated on your debt-reduction journey.

How to Effectively Use the Cnfans Loan Calculator

Getting started with the Cnfans template is a straightforward, three-step process designed for maximum insight with minimal effort. This structure allows you to quickly move from basic data to strategic financial planning.

Step 1: Inputting Your Core Loan Details

Begin by entering the fundamental information about your loan into the designated cells. This includes the Loan Amount (principal), the Annual Interest Rate, the Loan Period (in years or months), and the start date of the loan. The template will instantly compute your scheduled monthly payment and populate the main dashboard.

Step 2: Exploring the Impact of Extra Payments

This is where strategic planning begins. The template includes a dedicated section for "Extra Payments." By inputting an additional amount you plan to pay each month, you can immediately see the dramatic effect it has. The summary will update to show you a new, earlier payoff date and the total amount of interest you will save. This feature is a powerful motivator for accelerating debt repayment.

Step 3: Analyzing the Visual Dashboard

With your data entered, take time to review the main dashboard. Examine the summary that shows the total interest you will pay and the loan's end date. Look at the charts to visualize the breakdown of principal versus interest. Scroll through the amortization schedule to understand how your balance will decrease with each payment. This analysis provides the complete picture needed for confident financial management.

Which Loan Scenarios Can You Analyze with This Template?

The versatility of the Cnfans Loan Calculator makes it suitable for a wide array of borrowing situations, from everyday consumer credit to significant long-term investments.

Personal Loans and Auto Financing

Whether you're financing a new car, consolidating credit card debt with a personal loan, or paying for a major expense, this template is perfect. It allows you to quickly compare offers from different banks or credit unions, ensuring you get the most favorable terms. You can confidently determine what monthly payment fits your budget before ever signing an agreement.

Mortgages and Real Estate Investments

For what is often the largest financial commitment of a person's life, a mortgage, this tool is indispensable. Model different down payments, interest rates, and loan terms (e.g., 15-year vs. 30-year). Analyze the impact of making bi-weekly payments or adding a small extra amount to your monthly payment. For real estate investors, it's an essential tool for calculating the financial viability of a rental property.

How Can You Compare Different Loan Offers Side-by-Side?

The Cnfans template makes comparing loan offers simple and effective. To analyze two or more options, you can save separate copies of the spreadsheet for each loan scenario. For example, create "Loan_Offer_A.xlsx" and "Loan_Offer_B.xlsx." Input the specific terms for each offer into its respective file.

Once you have both scenarios populated, place them side-by-side on your screen. You can then directly compare the critical outputs: the monthly payment, the total interest paid over the life of the loan, and the loan payoff date. This direct comparison removes any ambiguity and highlights which offer is truly more affordable in the long run, even if the monthly payments are similar.

What is the Strategic Advantage of Planning for Extra Payments?

The single most powerful feature for debt reduction is the ability to model extra payments. The strategic advantage is twofold: saving money and saving time. When you make a payment, a portion goes to interest and a portion to principal. Any extra payment you make typically goes entirely toward the principal.

By reducing the principal faster, you decrease the balance upon which future interest is calculated. This creates a snowball effect: less interest accrues each month, meaning more of your standard payment goes toward principal, and the loan is paid off much faster. The Cnfans template quantifies this advantage instantly, showing you that even a small extra payment of $50 or $100 per month can shave years off a mortgage and save you tens ofthousands of dollars in interest.

Understanding Key Loan Terminology

Familiarizing yourself with the language of lending is essential. The template uses standard financial terms, which are crucial to understand for effective loan management.

| Term | Definition |

|---|---|

| Principal | The initial amount of money borrowed from the lender, before any interest is added. |

| Interest Rate | The percentage of the principal charged by the lender for the use of its money, typically expressed as an annual rate. |

| Term | The length of time over which the loan is scheduled to be repaid, such as 5 years for a car loan or 30 years for a mortgage. |

| Amortization | The process of paying off a debt over time through regular, scheduled payments. Each payment covers both interest and principal. |

| Monthly Payment | The fixed amount paid by the borrower to the lender each month to repay the loan over its term. |

How is the Cnfans Template Superior to a Basic Spreadsheet?

While one could attempt to build a loan calculator from scratch, the Cnfans spreadsheet 2025 Loan Calculator Template provides unmatched value. Creating a basic calculator is simple, but building one with a dynamic amortization schedule, extra payment functionality, and visual dashboards is a complex and time-consuming task. It requires deep knowledge of spreadsheet formulas and a keen eye for design to avoid errors.

The Cnfans template is professionally built, rigorously tested for accuracy, and designed for an optimal user experience. It saves you hours of work and eliminates the risk of formula errors that could lead to flawed financial decisions. With pre-built charts, conditional formatting, and a polished interface, it offers a level of sophistication that a DIY spreadsheet rarely achieves. It's a ready-made solution that provides immediate, reliable, and actionable financial insights.

Who Can Benefit Most from This Financial Tool?

This template is a valuable asset for a wide range of individuals seeking to navigate the world of borrowing with confidence and strategic foresight.

- First-Time Home Buyers: An essential tool for understanding the magnitude of a mortgage and planning for long-term financial health.

- Students and Graduates: Perfect for managing student loans, understanding repayment options, and creating a strategy to pay them off efficiently.

- Small Business Owners: Ideal for analyzing business loans for equipment, expansion, or working capital, ensuring the debt is manageable and profitable.

- Financial Planners: A great resource to use with clients to visually demonstrate loan concepts and debt management strategies.

- Anyone Planning a Major Purchase: From a new car to a home renovation, this template provides the clarity needed to finance any large expense wisely.