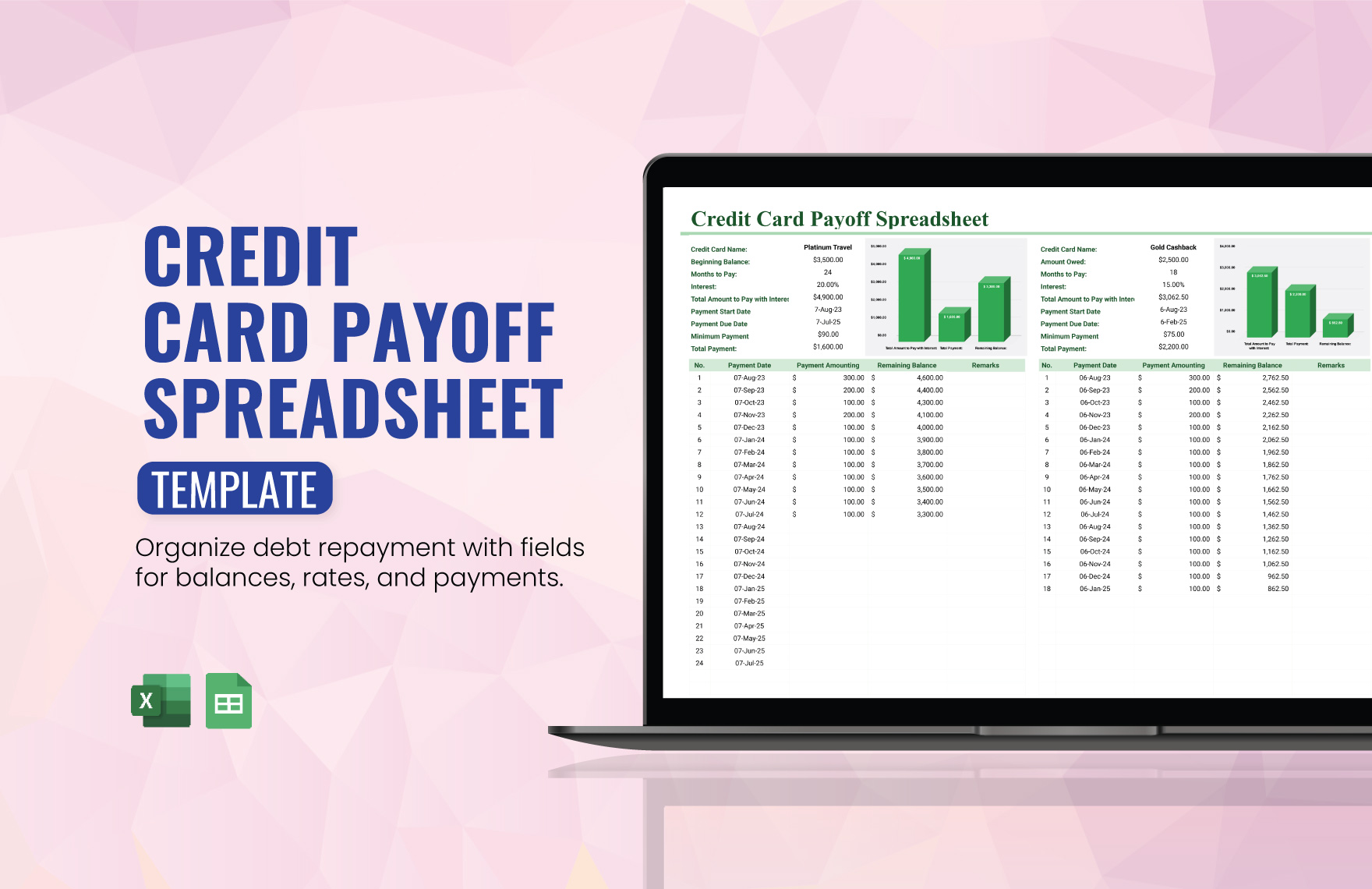

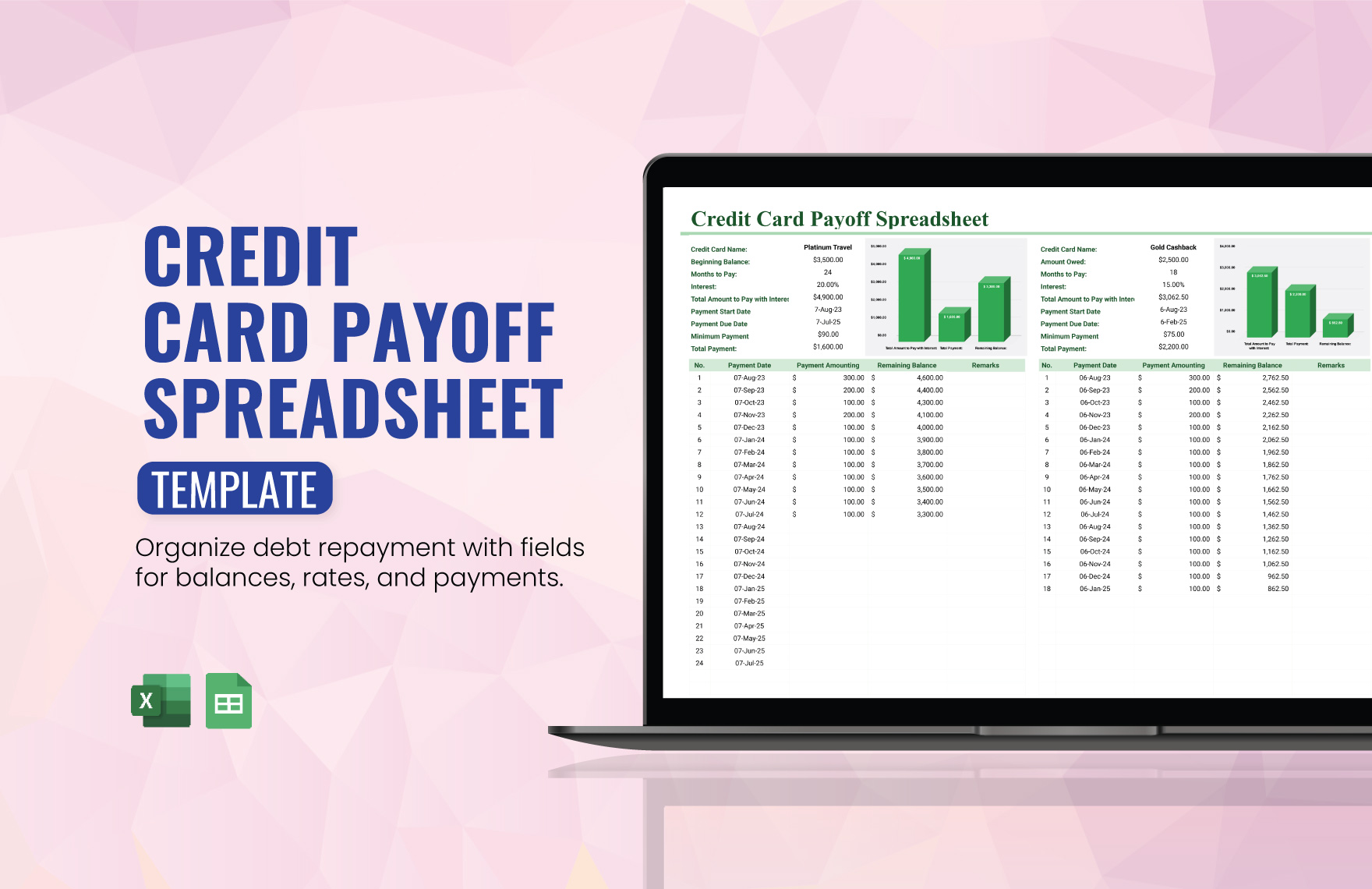

The Cnfans Spreadsheet 2025 Credit Card Management Template is a comprehensive digital tool designed to help you organize, track, and strategically pay down credit card debt. It provides a centralized dashboard to monitor all your card balances, interest rates, due dates, and payment history, empowering you to take firm control of your financial standing and simplify complex financial information into actionable insights.

Why Is a Dedicated Credit Card Tracker Essential for Financial Health?

Managing multiple credit cards can quickly become a complex juggling act. With different balances, varying interest rates (APRs), and staggered due dates, it's easy to lose track. This lack of clarity can lead to missed payments, which incur late fees and negatively impact your credit score. More importantly, without a clear picture of your total debt, high-interest balances can quietly accumulate, costing you hundreds or even thousands of dollars in interest charges over time.

A systematic approach is necessary to move from financial stress to financial command. Using a dedicated tracker transforms abstract debt into tangible data. It allows you to see exactly where your money is going, which cards carry the most expensive debt, and how your payments are making a difference. This visibility is the first step toward creating an effective payoff plan, reducing interest costs, and accelerating your journey to becoming debt-free. It shifts your role from being a passive debtor to an active manager of your own finances.

Introducing the Cnfans 2025 Credit Card Management Solution

Recognizing the need for a simple yet powerful tool, the team at Cnfans has meticulously crafted the Cnfans spreadsheet 2025 Credit Card Management Template. Drawing on our expertise in creating intuitive and effective financial planning tools, this template is more than just a set of columns and rows. It is an all-in-one system designed for clarity, efficiency, and empowerment. It eliminates the guesswork and manual calculations that often make financial management feel like a chore.

Our design philosophy is centered on the user. We understand that you need a tool that is both comprehensive in its features and simple to use. The 2025 Credit Card Management Template consolidates all your critical credit card information into one dynamic, easy-to-navigate interface. With built-in formulas, visual dashboards, and strategic planners, it provides the structure you need to make informed decisions and achieve your financial goals with confidence.

What Core Features Set the Cnfans Template Apart?

This template is engineered with specific functionalities that address the most common challenges of credit card management. It focuses on automation, visualization, and strategic planning to provide a superior user experience.

Centralized Dashboard for At-a-Glance Insights

The heart of the Cnfans template is its dynamic summary dashboard. Instead of sifting through multiple statements or banking apps, you get a single, consolidated view of your entire credit card portfolio. This dashboard instantly displays key metrics such as:

- Total outstanding debt across all cards.

- Overall credit utilization percentage.

- Upcoming payment due dates and minimum amounts.

- A visual breakdown of debt per card.

This high-level perspective is critical for quick assessments and progress tracking. Powerful charts and graphs turn raw numbers into clear, actionable visuals, helping you understand your financial position in seconds.

Automated Payment and Due Date Tracking

Forgetting a payment due date can be a costly mistake. The Cnfans template includes an automated reminder system that highlights upcoming payments. By simply inputting your statement and due dates for each card, the sheet organizes them chronologically and flags which payments are next. This proactive feature helps you avoid late fees and maintain a perfect payment history, which is a cornerstone of a healthy credit profile. The sheet also calculates your total minimum payment required each month, ensuring you are always prepared.

Detailed Transaction Logging and Categorization

To truly master your spending, you need to know where your money is going. The template provides a dedicated section for logging individual transactions for each credit card. You can assign categories to each purchase (e.g., Groceries, Utilities, Entertainment), which then feeds into a spending analysis report. This functionality helps you identify spending habits, create a realistic budget, and pinpoint areas where you can cut back to free up more money for debt repayment.

How Do You Use the Cnfans Credit Card Spreadsheet Effectively?

Getting started with the Cnfans template is a straightforward process designed for immediate impact. The initial setup involves gathering your credit card statements and populating the "Setup" tab. Here, you will enter the essential information for each card: the card name, the current balance, the interest rate (APR), and the credit limit.

Once the initial data is entered, the primary task is to maintain it. This means logging new transactions as they occur and recording payments as you make them. The template is designed to make this process quick and efficient. As you input this data, all the dashboards, charts, and summary tables update automatically. The key to success is consistency. By spending just a few minutes each week updating your transactions and payments, you will maintain an accurate and powerful real-time view of your financial landscape, enabling you to adapt your strategy as needed.

Strategic Debt Reduction: Avalanche vs. Snowball Methods Explained

The Cnfans template is uniquely equipped to support the two most popular debt reduction strategies: the Avalanche and Snowball methods. Choosing the right one depends on your financial situation and psychological motivation. The template allows you to model both approaches to see which one aligns better with your goals.

The Avalanche method focuses on tackling the card with the highest interest rate first while making minimum payments on all others. This approach saves the most money on interest over time, making it the most financially efficient. The Snowball method involves paying off the card with the smallest balance first, regardless of its interest rate. This strategy provides quick psychological wins, as you see individual debts eliminated faster, which can build momentum and keep you motivated.

The following table breaks down the differences:

| Aspect | Debt Avalanche Method | Debt Snowball Method |

|---|---|---|

| Primary Focus | Highest Interest Rate (APR) Card | Smallest Balance Card |

| Financial Benefit | Saves the most money on interest charges over time. | Saves less on interest compared to Avalanche. |

| Psychological Benefit | Less motivational initially, as progress on large-balance cards can feel slow. | Highly motivational due to quick wins from paying off small balances. |

| Best For | Individuals who are disciplined and motivated by long-term financial optimization. | Individuals who need early encouragement and momentum to stay on track. |

The Cnfans template includes a debt payoff planner where you can allocate extra payments and see how each strategy impacts your debt-free date and total interest paid, empowering you to make a data-driven choice.

Beyond Debt: Unlocking the Full Potential of Your Credit Cards

Effective credit card management extends beyond just paying off debt. It also involves using your cards strategically to benefit your overall financial health. The Cnfans template includes features to help you do just that.

Maximizing Rewards and Cashback

Many credit cards offer valuable rewards, from cashback and travel points to exclusive discounts. However, these benefits are worthless if they are not tracked and utilized. The template allows you to note the rewards structure for each card (e.g., "3% on groceries," "1.5% on all purchases"). By tracking your spending by category, you can ensure you are using the right card for the right purchase to maximize your returns. This turns your everyday spending into a value-generating activity.

Monitoring Credit Utilization for a Better Credit Score

Your credit utilization ratio—the amount of credit you are using compared to your total available credit—is a major factor in determining your credit score. Lenders prefer to see a ratio below 30%. The Cnfans template automatically calculates your utilization for each card and your overall ratio. The dashboard provides a clear visual indicator of this metric, allowing you to see if you are approaching a high-utilization threshold. By monitoring this, you can make strategic payments to keep your ratio low, which can lead to a significant improvement in your credit score over time.

Who Can Benefit Most from This Financial Management Tool?

This credit card management template is a versatile tool designed for a wide range of individuals seeking financial clarity and control. It is particularly beneficial for:

- Individuals with Multiple Credit Cards: Anyone juggling several cards will find immense value in the centralized dashboard, which simplifies tracking and prevents missed payments.

- Those Embarking on a Debt-Free Journey: If your primary goal is to eliminate credit card debt, the strategic payoff planners for the Avalanche and Snowball methods are indispensable.

- Budget-Conscious Families: Households can use the transaction categorization to monitor spending, stick to a budget, and work together toward shared financial goals.

- Financial Novices: For those new to managing credit, the template provides a structured learning tool that teaches fundamental principles of credit health, such as utilization and payment history.

- Data-Driven Planners: Anyone who appreciates seeing their financial data visualized in charts and graphs will benefit from the template’s insightful and automated reporting.

Comparing the Cnfans Template to DIY Spreadsheets and Apps

While you could build your own spreadsheet or use a third-party app, the Cnfans template offers a unique blend of benefits that provide superior value. It strikes a perfect balance between the customization of a DIY sheet and the functionality of a premium app, without the common drawbacks of either.

| Feature | Cnfans 2025 Template | DIY Spreadsheet | Third-Party App |

|---|---|---|---|

| Setup Time | Minimal. Pre-built and ready to use. | High. Requires significant time and Excel/Sheets knowledge. | Quick, but involves linking bank accounts. |

| Functionality | Advanced features like dashboards and strategy planners are included. | Limited by your skill. Building automated dashboards is complex. | Varies by app; premium features often require a subscription. |

| Customization | Highly customizable within a professional framework. | Fully customizable, but can be messy and prone to errors. | Limited to the features provided by the developer. |

| Data Privacy | Maximum security. Your data stays on your local device or personal cloud. | Maximum security. You own and control the file. | Potential risk. Requires sharing login credentials and financial data with a third party. |

| Cost | A one-time purchase for lifetime value. | Free, but costs significant time and effort. | Often free with ads or requires a recurring monthly/annual subscription. |

Is the Cnfans Spreadsheet Secure for Sensitive Financial Data?

Data security is a paramount concern when dealing with financial information. This is an area where the Cnfans spreadsheet provides a distinct advantage. Unlike many financial apps that require you to link your bank accounts and share your login credentials, this template is a standalone file. Whether you use it in Microsoft Excel or Google Sheets, the file resides on your local computer or within your personal cloud storage (like Google Drive or OneDrive).

You are in complete control of your information. There is no third-party server storing your data, no risk of a company-wide data breach exposing your details, and no sharing of credentials. You can further enhance security by password-protecting the file itself. This approach provides the peace of mind that your sensitive financial data remains private and exclusively under your management, combining powerful functionality with robust, user-controlled security.

Getting Started with Your 2025 Credit Card Management Template

Taking the first step toward complete financial control is simple. You can acquire the Cnfans Spreadsheet 2025 Credit Card Management Template directly from our official website. The template is available for both Microsoft Excel and Google Sheets, ensuring compatibility regardless of your preferred platform. Upon purchase, you will receive an instant download link, allowing you to begin organizing your finances immediately.

Embrace the clarity and confidence that comes with a well-organized financial life. Stop letting credit card debt manage you, and start managing it with purpose and strategy. With this powerful tool at your fingertips, you can build a clear path to debt freedom and a healthier financial future.