To effectively manage a family budget in 2025, start by calculating your total monthly net income and meticulously tracking all expenses to understand your cash flow. Next, choose a budgeting method that suits your family's style, such as the 50/30/20 rule or zero-based budgeting. Utilize a powerful tool like a digital spreadsheet to categorize spending, set savings goals, and regularly review your progress to make informed financial decisions and trim unnecessary costs.

Table of Contents

- Why is a Structured Family Budget Essential for 2025?

- Getting Started: The First Steps to Financial Clarity

- Choosing the Right Budgeting Method for Your Family

- Building Your Budget with the CNfans Family Budget Spreadsheet

- What Are the Top Strategies for Cutting Household Expenses?

- How to Set and Achieve Meaningful Financial Goals

- Involving the Whole Family in the Budgeting Process

- The Importance of Regular Budget Reviews and Adjustments

- What Role Does an Emergency Fund Play in Your Family's Budget?

- Frequently Asked Questions About Family Budgeting

Why is a Structured Family Budget Essential for 2025?

A well-defined spending plan is the bedrock of a family's financial health. In an era of economic uncertainty and rising costs, creating a budget moves you from a reactive state of financial anxiety to a proactive position of control. It provides a clear roadmap, illustrating precisely where your money is going and empowering you to direct it toward what matters most. This clarity helps reduce marital stress often associated with finances and fosters a sense of teamwork.

Beyond simply managing day-to-day expenses, a structured budget is a powerful tool for achieving long-term aspirations. Whether your goal is a down payment on a new home, a memorable family vacation, funding your children's education, or securing a comfortable retirement, a budget transforms those dreams into actionable steps. It allows you to systematically allocate funds, track your progress, and stay motivated as you watch your goals move closer to reality.

Getting Started: The First Steps to Financial Clarity

Embarking on your budgeting journey begins with establishing a clear baseline. Without understanding your income and outgoings, any attempt to manage money is simply guesswork. This initial phase is about gathering data to build a realistic and sustainable financial plan.

How to Accurately Calculate Your Total Family Income

The first piece of the puzzle is knowing exactly how much money your family brings in each month. It’s critical to work with your net income—the amount you take home after taxes, insurance premiums, and other deductions. Sum up all sources of income for your household. This includes primary salaries, part-time wages, freelance earnings, side-hustle profits, and any other regular cash inflows. If you have variable income, it's wise to calculate an average from the past six to twelve months to establish a conservative and reliable figure for your budget.

Uncovering Your Spending Habits: Where Does the Money Go?

This is often the most eye-opening step. For at least one full month, you must track every single dollar your family spends. From the mortgage payment and car loans (fixed expenses) to groceries, coffee runs, and streaming subscriptions (variable expenses), everything must be recorded. This process reveals "budget leaks"—small, frequent purchases that add up significantly over time.

While you can use a notebook or a basic notes app, this is where a dedicated financial tracker shines. A specialized spreadsheet simplifies this process, allowing you to easily categorize each transaction. This meticulous tracking isn't about judgment; it's about awareness. You cannot change what you do not measure, and this data forms the foundation upon which your entire budget will be built.

Choosing the Right Budgeting Method for Your Family

There is no one-size-fits-all approach to budgeting. The best method is one that your family can understand and stick with consistently. The key is to find a framework that aligns with your financial personality and goals. Exploring a few popular methods can help you identify the right fit.

Some families thrive on simplicity, while others prefer meticulous detail. The 50/30/20 rule is great for beginners, allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. Conversely, zero-based budgeting requires that every dollar of income is assigned a job, ensuring no money is unaccounted for. This method offers maximum control but demands more effort. The digital envelope system is another option, where you allocate specific amounts to digital "envelopes" for different spending categories.

| Budgeting Method | Best For | Key Principle | Level of Effort |

|---|---|---|---|

| 50/30/20 Rule | Beginners and those who prefer a simple, guideline-based approach. | Divides take-home pay into three categories: 50% Needs, 30% Wants, 20% Savings. | Low |

| Zero-Based Budgeting | Detail-oriented individuals and families with variable income. | Income minus Expenses equals Zero. Every dollar is assigned a purpose. | High |

| Digital Envelope System | Visual planners who want to prevent overspending in specific categories. | Allocate a set amount of cash to virtual spending categories. When the "envelope" is empty, spending stops. | Medium |

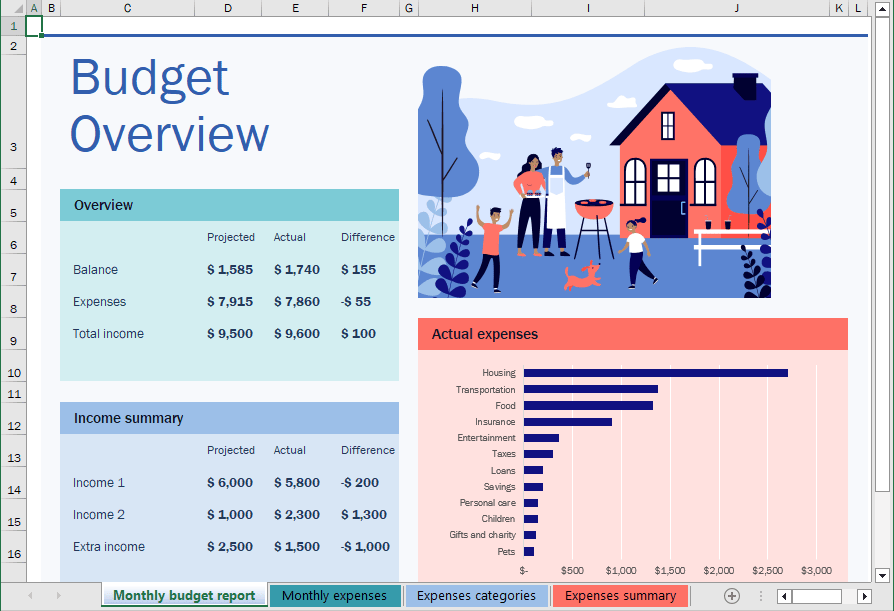

Building Your Budget with the CNfans Family Budget Spreadsheet

Once you understand your finances and have a method in mind, it's time to implement it. A powerful, intuitive tool can make the difference between a frustrating chore and a successful financial habit. The CNfans Family Budget Spreadsheet is designed to simplify this process, offering the flexibility to adapt to any budgeting style while providing powerful insights into your financial life.

This dynamic spreadsheet moves beyond static numbers. It’s engineered to be a central hub for your family's finances, combining user-friendly design with robust functionality. It removes the intimidation factor from budgeting, making it an accessible and even engaging activity for everyone involved.

Setting Up Your Categories and Subcategories

A major advantage of using a dedicated template is its thoughtful structure. The CNfans spreadsheet comes with pre-built, comprehensive categories like Housing, Transportation, Food, and Debt. More importantly, it allows for full customization. You can add, delete, or rename categories to perfectly match your family’s unique spending patterns. Create subcategories like "Streaming Services," "Kids' Sports Fees," or "Pet Insurance" to gain an even more granular understanding of your expenditures. This personalization ensures the budget reflects *your* life, not a generic template.

Automating Calculations and Visualizing Your Finances

Forget manual calculations and the risk of human error. As you input your income and expenses, the spreadsheet automatically computes totals, tracks spending against your budget, and calculates your savings rate. The real power lies in the visual dashboard. Interactive charts and graphs instantly show you what percentage of your income goes to housing, how your grocery spending is trending month-over-month, or how close you are to reaching a savings goal. This visual feedback is incredibly motivating and makes complex financial data easy to digest at a glance.

What Are the Top Strategies for Cutting Household Expenses?

Identifying areas to save money is a critical outcome of budgeting. Once your spending is categorized, you can pinpoint opportunities to trim costs without drastically impacting your quality of life. Small, consistent changes can lead to substantial savings over time.

Reducing Your Grocery Bill Without Sacrificing Quality

Food is one of the largest variable expenses for most families, making it a prime area for savings. Start by meal planning for the week ahead. This allows you to create a precise shopping list, which is your best defense against impulse buys. Consider shopping for store brands, which often offer the same quality as name brands for a fraction of the price. Buying non-perishable items in bulk can also lead to significant savings, as can shopping at discount grocers or using coupons and cash-back apps.

Trimming Utility and Subscription Costs

The "set it and forget it" nature of recurring payments can be a major budget drain. Conduct a subscription audit at least twice a year. Go through your bank statements and identify all recurring charges for streaming services, software, apps, and subscription boxes. Ask yourself: Do we still use and value this service? Cancel anything that is no longer essential. For utilities, adopt energy-saving habits like using programmable thermostats, switching to LED bulbs, and unplugging electronics when not in use. It's also worth shopping around for new internet or phone providers annually to see if you can find a better deal.

Smart Savings on Transportation and Entertainment

Transportation costs can be reduced by optimizing your driving. Plan your errands to make fewer trips, and consider carpooling or using public transport when feasible. Regular car maintenance, such as keeping tires properly inflated, can also improve fuel efficiency. For entertainment, look for free or low-cost activities in your community, such as parks, libraries, and local festivals. A family movie night at home can be just as fun and far less expensive than a trip to the theater.

How to Set and Achieve Meaningful Financial Goals

A budget isn't just about restriction; it's about intention. It empowers you to channel your money toward building the life you want. Setting clear financial goals provides the motivation to stick to your spending plan, transforming budgeting from a chore into an exciting journey.

Use the SMART framework to define your objectives: make them Specific, Measurable, Achievable, Relevant, and Time-bound. Instead of a vague goal like "save more money," a SMART goal would be: "Save $5,000 for a family trip to the beach in 12 months by automating a transfer of $417 per month into a dedicated savings account." This level of detail makes the goal concrete and provides a clear path to success. The goal-tracking features within a spreadsheet allow you to monitor your progress visually, which reinforces positive behavior and keeps you focused.

Involving the Whole Family in the Budgeting Process

For a family budget to be truly effective, it must be a team effort. When one partner imposes a budget on the other, it can lead to resentment and failure. Schedule regular, calm money meetings to discuss goals, review spending, and make decisions together. Transparency is key. Everyone should understand the family's financial situation and the "why" behind the budget.

Even children can be involved in an age-appropriate way. This teaches them valuable lessons about money management. You can discuss the difference between needs and wants when shopping or show them the progress toward a family goal they are excited about, like a vacation. When everyone feels heard and has a stake in the outcome, the budget becomes a shared project for the family's collective good.

The Importance of Regular Budget Reviews and Adjustments

A budget is not a rigid document set in stone. It is a living, breathing plan that must adapt to your family's changing circumstances. Life is unpredictable: incomes change, new expenses arise, and priorities shift. A budget that isn't reviewed regularly will quickly become obsolete and ineffective.

Set aside time at least once a month to sit down and review your budget. How did your actual spending compare to your plan? Where did you overspend? Where did you save? This monthly check-in allows you to make necessary adjustments for the month ahead. Perhaps you need to allocate more to groceries or less to entertainment. Using a digital tool like the CNfans spreadsheet makes this process simple, as all the data is already organized, allowing you to quickly analyze trends and recalibrate your plan. This iterative process of tracking, reviewing, and adjusting is the secret to long-term budgeting success.

What Role Does an Emergency Fund Play in Your Family's Budget?

An emergency fund is the financial safety net that protects your family and your budget from life's unexpected events. It is a pool of readily accessible cash set aside specifically for true emergencies, such as a job loss, a major medical bill, or an urgent home repair. Without this fund, such events would force you into debt or require you to derail your long-term financial goals, like retirement savings.

Financial experts typically recommend saving three to six months' worth of essential living expenses. This might seem daunting, but you can build it over time. Start by making it a non-negotiable category in your budget, even if you can only contribute a small amount each month. Automate the transfer to a separate, high-yield savings account so you aren't tempted to spend it. Building this fund provides immense peace of mind and is one of the most important steps you can take toward financial stability.

Frequently Asked Questions About Family Budgeting

Navigating the world of family finances can bring up many questions. Here are answers to some of the most common inquiries.

How often should we review our family budget?

It is highly recommended to have a brief check-in weekly to track spending and a more thorough review session once a month. The monthly review is the perfect time to analyze spending, celebrate wins, adjust categories for the upcoming month, and ensure you are still on track with your long-term goals.

What's the best way to handle unexpected income like a bonus?

It's wise to have a plan for windfalls *before* you receive them. A great strategy is to allocate the funds according to your priorities. For example, you could use 50% to aggressively pay down high-interest debt, 30% to boost long-term savings or investments, and 20% for a fun family purchase or experience. This balanced approach helps you advance your goals while also enjoying the reward.

Can a spreadsheet really be better than a budgeting app?

While many apps are convenient, they often come with limitations, monthly fees, or data privacy concerns. A powerful spreadsheet, like those offered by CNfans, provides unparalleled flexibility and control. You own your data, and you can customize every aspect to fit your family's specific needs—something most apps cannot offer. The ability to see all your financial data in one comprehensive dashboard, without ads or upsells, gives you a clearer, more powerful perspective on your money.