To efficiently manage your personal finance with a spreadsheet, you must first establish a financial baseline by listing all assets and liabilities. Next, create a detailed budget by tracking every source of income and categorizing all expenses. Use the spreadsheet’s features to set clear financial goals, monitor your spending patterns against your budget, and track your net worth over time. A dedicated tool like a Cnfans spreadsheet streamlines this process with automated calculations, visual dashboards, and pre-built templates for debt repayment and investment tracking.

Table of Contents

- What Makes a Spreadsheet the Ultimate Personal Finance Tool?

- Laying the Groundwork: Your First Steps to Financial Clarity

- Mastering Day-to-Day Finances with an Automated System

- Advanced Strategies for Long-Term Wealth Building

- Maintaining Momentum: The Art of the Financial Review

What Makes a Spreadsheet the Ultimate Personal Finance Tool?

In a world of countless finance apps, the humble spreadsheet remains a powerhouse for personal finance management. Unlike rigid applications that lock you into specific categories or views, a spreadsheet offers unparalleled flexibility. It empowers you to build a financial system that is perfectly tailored to your unique life, goals, and habits. You are in the driver's seat, able to decide what to track, how to categorize it, and how to visualize your progress without being constrained by a developer's predetermined framework.

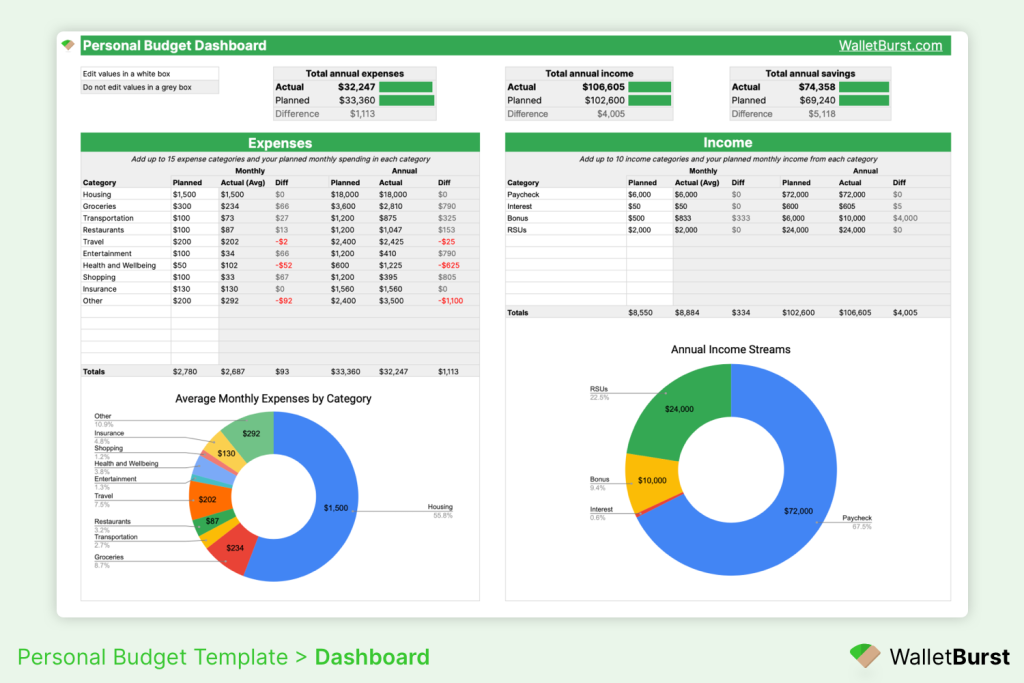

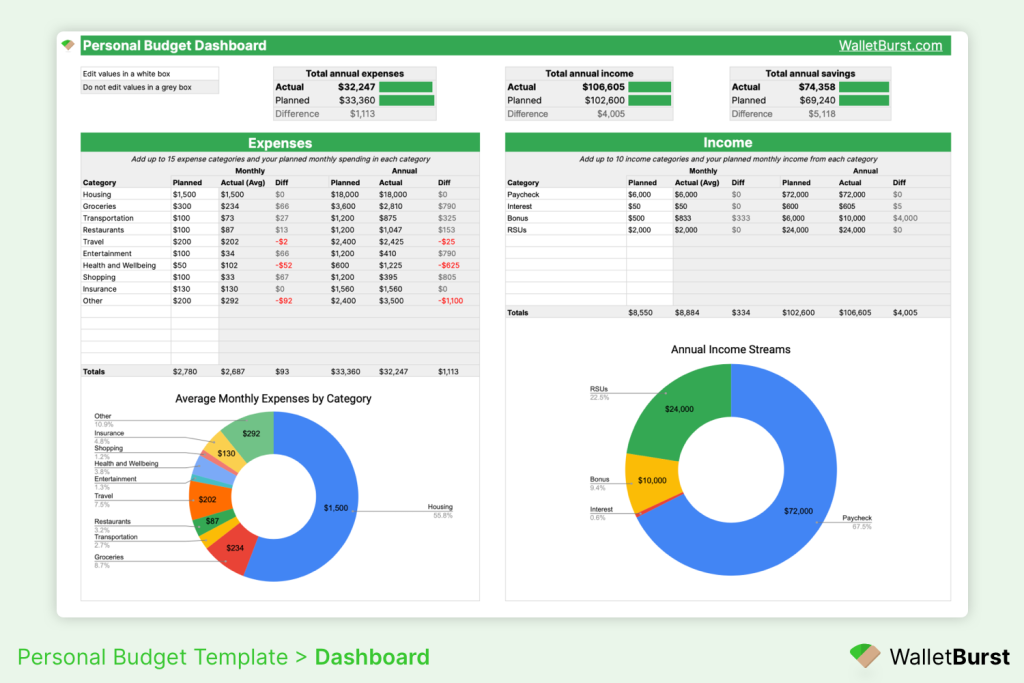

The true power is unlocked when you move beyond a basic, manually-updated sheet. Modern solutions, such as the templates offered by Cnfans, are built on platforms like Google Sheets and come pre-loaded with sophisticated formulas, conditional formatting, and interactive charts. This transforms a simple ledger into a dynamic financial command center, providing clarity and insight with minimal manual effort.

Gaining Unmatched Control and Customization

Generic finance apps often fail because they impose a one-size-fits-all approach to a deeply personal matter. Your financial life is unique; it includes specific income streams, variable expenses, and personal goals that don't fit neatly into pre-made boxes. A high-quality budgeting spreadsheet puts you in complete control. You can create spending categories that actually make sense for your lifestyle, whether it’s "Weekend Hobbies," "Pet Care," or "Professional Development."

This level of customization is not just about labeling; it's about relevance. When your budget reflects your actual life, you are far more likely to engage with it. With a Cnfans spreadsheet, the complex structure is already built, but the categories and details are fully adaptable. You can modify, add, or remove items to create a financial mirror of your reality, making the entire process more intuitive and effective.

Visualizing Your Financial Journey

Numbers on a page can be abstract and uninspiring. The key to staying motivated is to see the impact of your decisions visually. Spreadsheets excel at transforming raw data into insightful charts and graphs. An automated personal finance dashboard can show you at a glance your income vs. expense trends, how your spending breaks down by category, and the month-over-month growth of your net worth.

This visual feedback is a powerful motivator. A pie chart that reveals 20% of your income is going to "Dining Out" is far more impactful than a single number in a cell. Seeing your net worth line chart trend upwards provides a tangible sense of accomplishment. Cnfans templates are designed with these visual dashboards at their core, automatically updating graphs as you input your data, providing instant feedback on your financial health and progress toward your goals.

Laying the Groundwork: Your First Steps to Financial Clarity

Before you can effectively manage your money, you need a clear and honest picture of your current financial situation. Attempting to create a budget or set goals without this foundational knowledge is like trying to navigate a new city without a map. This initial phase is about gathering data and setting a direction, which will serve as the bedrock of your entire financial strategy.

Establishing Your Financial Baseline: Where Do You Stand Today?

Your financial baseline is a snapshot of your financial health at this very moment. It involves calculating your net worth, which is the simple formula of what you own (assets) minus what you owe (liabilities). This single number provides immense clarity.

First, list all your assets: the balance of your checking and savings accounts, the current value of any investments (stocks, retirement funds), the market value of your home and vehicles, and any other valuable possessions. Next, list all your liabilities: credit card balances, student loans, car loans, mortgages, and any other outstanding debts. The difference between these two totals is your net worth. The Net Worth Tracker within the Cnfans suite is specifically designed to simplify this calculation and monitor it over time, giving you a clear starting point.

How to Set Meaningful and Attainable Financial Goals

Once you know where you stand, you can decide where you want to go. Vague aspirations like "save more money" or "get out of debt" are not effective. Instead, you need to set *SMART goals*:

- Specific: Clearly define what you want to achieve. (e.g., "Save for a down payment on a house.")

- Measurable: Quantify your goal. (e.g., "Save $30,000.")

- Attainable: Ensure the goal is realistic given your income and timeline.

- Relevant: The goal should align with your life values and priorities.

- Time-bound: Set a deadline. (e.g., "Within the next three years.")

A well-defined goal becomes your "why." It's the reason you'll choose to stick to your budget when tempted to overspend. Your spreadsheet can be used to break down these large goals into smaller, monthly targets, making them feel less daunting and more achievable.

Choosing a Budgeting Method That Works for You

A budget is not a financial straitjacket; it is a plan for your money. There are several popular methods, and the best one for you depends on your personality and financial situation. A spreadsheet is flexible enough to accommodate any of them.

| Budgeting Method | Description | Best For |

|---|---|---|

| 50/30/20 Rule | Allocate 50% of after-tax income to Needs, 30% to Wants, and 20% to Savings & Debt Repayment. | Beginners who want a simple, straightforward framework. |

| Zero-Based Budgeting | Assign every single dollar of income to a category (expenses, savings, debt) until your income minus your outgoings equals zero. | People who want maximum control and to optimize every dollar. |

| Pay Yourself First | Prioritize saving and investing by automating transfers to savings/investment accounts on payday, then spend what is left. | Those who struggle to save consistently and want to make it automatic. |

The Budget Planner template from Cnfans can be adapted to any of these methods. It allows you to set target amounts for each category and then visually compares your actual spending against your plan, providing immediate feedback on your performance.

Mastering Day-to-Day Finances with an Automated System

With your foundation and goals in place, the next step is to manage the daily flow of money. This is where many people fail, as manual tracking can be tedious and easy to neglect. An automated system is the key to consistency and long-term success, transforming a chore into a simple, sustainable habit.

The Core of Control: Diligent Income and Expense Tracking

You cannot manage what you do not measure. Diligent expense tracking is the process of recording every dollar you spend. This practice illuminates your financial habits, reveals areas of overspending, and holds you accountable to your budget. Without it, your budget is just a work of fiction.

Manually typing in every coffee purchase or grocery bill is unsustainable for most people. This is where the power of an automated budgeting spreadsheet becomes evident. The Cnfans spreadsheet, for instance, allows for quick transaction entry. By spending just a few minutes each day or a dedicated block of time each week to log your expenses, the spreadsheet does the heavy lifting. It automatically totals your spending by category, calculates your remaining budget, and updates your financial dashboards, providing a real-time view of your financial activity without the headache of manual calculations.

Uncovering Hidden Costs: How to Manage Subscriptions Effectively

In today's subscription economy, small, recurring charges for streaming services, software, and delivery apps can quickly add up to a significant monthly expense. These "financial termites" often go unnoticed but can eat away at your budget. A dedicated system for tracking them is essential.

Simply listing them out in a spreadsheet is a good first step. The Subscription Tracker template from Cnfans takes this a step further. It allows you to list each subscription, its cost, and its renewal date. The dashboard then calculates your total monthly and annual subscription costs, often revealing a surprisingly large number. This clarity empowers you to make informed decisions: Which services do you truly value? Which can you cancel to free up hundreds, or even thousands, of dollars per year for your more important financial goals?

Advanced Strategies for Long-Term Wealth Building

Effective personal finance management goes beyond just balancing a monthly budget. It’s about using your money as a tool to build long-term security and wealth. This involves strategic debt management, purposeful saving, and making your money work for you through investing.

Tracking Your Net Worth: The True Measure of Financial Health

While your monthly cash flow is important, your net worth is the ultimate indicator of your financial progress. A positive cash flow is great, but if your net worth isn't increasing over time, you may be running in place. Tracking this metric shifts your focus from simply "not overspending" to actively "building wealth."

Your spreadsheet should have a dedicated section or a separate template, like the Cnfans Net Worth Tracker, to log your assets and liabilities on a regular basis (e.g., monthly or quarterly). Watching your net worth grow as you pay down debt and increase your savings and investments is one of the most powerful motivators on your financial journey. It provides a high-level view that confirms your daily habits are contributing to your long-term success.

Developing a Smart Debt Repayment Plan

Not all debt is created equal. High-interest debt, such as from credit cards, can be a major obstacle to wealth creation. A strategic repayment plan is crucial. Two popular methods are the *Debt Snowball* (paying off the smallest debts first for psychological wins) and the *Debt Avalanche* (paying off the highest-interest debts first to save the most money).

Your spreadsheet is the perfect tool for implementing either strategy. You can list all your debts, their balances, interest rates, and minimum payments. By modeling different scenarios, you can determine which plan works best for you and how quickly you can become debt-free by applying extra payments. This systematic approach turns the overwhelming feeling of being in debt into a clear, actionable plan with a defined end date.

From Saving to Investing: Making Your Money Work for You

Saving money is for short-term goals and emergencies. Building long-term wealth requires investing. As you master your budget and free up cash flow, it’s time to allocate funds toward investments that have the potential to grow over time, such as stocks, bonds, or real estate.

While a personal finance spreadsheet isn't a replacement for an investment platform, it is essential for planning and tracking. You can use it to set investment goals (e.g., "Invest $500 per month into a retirement account"), monitor your contributions, and track the overall value of your investment portfolio as part of your net worth calculation. This integrates your investment strategy directly into your overall financial picture, ensuring it aligns with your budget and other long-term goals.

Maintaining Momentum: The Art of the Financial Review

Your financial plan is not a static document. It is a living plan that must be reviewed and adjusted regularly to remain effective. Life is dynamic—your income, expenses, and goals will change over time. Staying engaged with your finances through regular check-ins ensures your plan evolves with you and you stay on course.

Why Regular Check-ins Are Non-Negotiable

A weekly or monthly financial review is a critical habit for success. This is your dedicated time to update your expense tracking, review your spending against your budget, and check your progress toward your goals. It's a moment to be honest with yourself. Did you stick to your plan? Where did you go off track? What successes can you celebrate?

This regular cadence prevents small deviations from becoming major problems. It keeps your financial goals top of mind and reinforces your commitment. Using a tool like the Cnfans spreadsheet makes this review process efficient. The automated dashboards immediately show you your performance for the period, allowing you to quickly identify trends and make necessary adjustments without getting bogged down in manual calculations.

Adjusting Your Strategy for Life’s Changes

Life events—both big and small—will impact your finances. A pay raise, a new job, a marriage, the birth of a child, or an unexpected expense all require you to revisit and adjust your budget and goals. Your financial plan must be flexible enough to accommodate these changes.

During your financial reviews, you can proactively adjust your spreadsheet. A pay raise means you can decide how to allocate that new income—perhaps increasing your investment contributions or accelerating your debt repayment. An upcoming large expense can be planned for by temporarily reducing spending in other categories. This proactive management ensures that life’s changes don't derail your financial progress; instead, your plan adapts to support you through every stage of life.