Handling customs for your CNfans purchases involves accurately completing a declaration form before international shipping. You must declare a reasonable value for your parcel's contents, provide a simple description for each item category (e.g., "Men's Shoes," "Cotton T-shirt"), and ensure the total declared value aligns with the regulations of your destination country and the shipping line you've chosen. This ensures a smoother transit process and minimizes the risk of delays or inspections.

Table of Contents

- What Exactly is a Customs Declaration and Why is it Mandatory?

- How to Complete Your Declaration on the CNfans Platform

- What is the Correct Value to Declare for My Parcel?

- How Does CNfans Streamline the Customs Declaration Process?

- Which Shipping Lines Have Special Declaration Rules?

- What is IOSS and How Does it Impact EU-Bound Parcels?

- What are Common Declaration Mistakes You Should Avoid?

- What Should You Do if a Parcel is Held by Customs?

- Can Parcel Insurance Cover Customs Seizures?

What Exactly is a Customs Declaration and Why is it Mandatory?

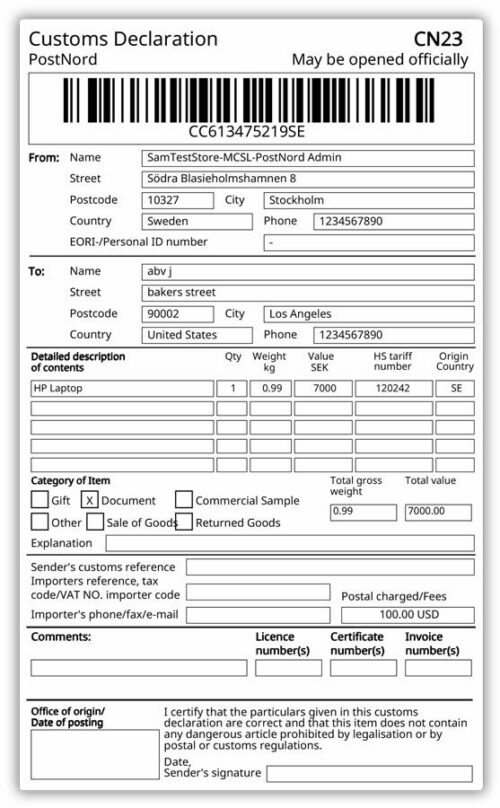

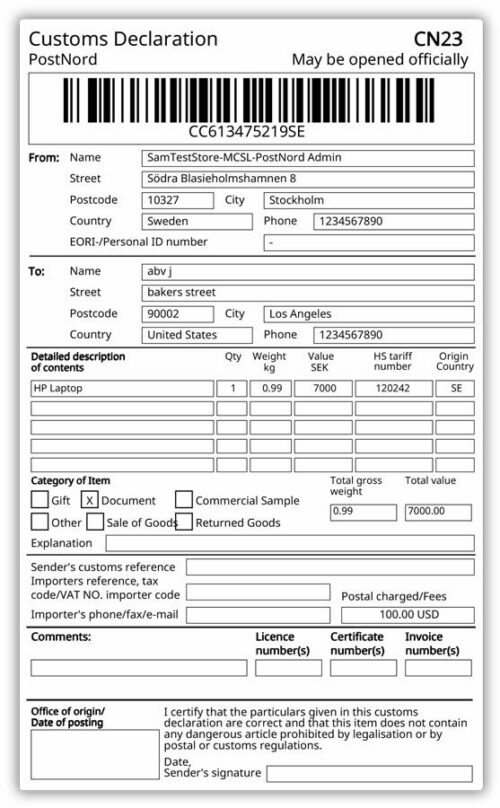

A customs declaration is a formal document that lists and details the goods being imported or exported. When you ship a parcel internationally, this document is the first thing customs authorities in the destination country look at. Its primary purpose is to provide officials with the necessary information to assess if any duties or taxes (like VAT or GST) are owed. It also allows them to verify that the contents of the parcel comply with their country's import regulations.

For anyone making CNfans spreadsheet purchases, completing this declaration is a mandatory step in the international shipping process. Without it, your parcel cannot leave the warehouse. A properly filled-out declaration facilitates a smooth journey through customs checkpoints. An inaccurate or suspicious declaration, however, can lead to inspections, delays, additional fees, or in the worst-case scenario, seizure of the parcel. Think of it as a passport for your goods; it must be accurate and credible to ensure entry.

How to Complete Your Declaration on the CNfans Platform

When you are ready to ship your consolidated items from the CNfans warehouse, you will proceed to the international shipping submission page. Here, after selecting your items and choosing a shipping line, you will be presented with the customs declaration interface. This section is where you will input the details that customs officials will see. The system is designed to be user-friendly, guiding you through each required field to ensure you provide all necessary information.

What Information is Required for the Declaration?

The declaration form requires specific details about the contents of your parcel. While the CNfans system may pre-fill some information based on your stored items, you are ultimately responsible for its accuracy. You will need to carefully review and input the following:

| Field | What to Provide | Example |

|---|---|---|

| Item Category | A general, simple description of the items. | Men's Shoes, Cotton T-shirt, Phone Case |

| Quantity | The number of items within that specific category. | 2, 3, 1 |

| Unit Value (USD) | The declared price for a single item in that category. | $15, $8, $5 |

| Total Value (USD) | Automatically calculated (Quantity x Unit Value). | $30, $24, $5 |

How Should You Describe Your Items?

When describing your items, clarity and simplicity are key. Avoid using brand names, specific model numbers, or overly detailed descriptions. Instead, use generic terms that accurately represent the product. For instance, instead of "Air Jordan 1 Retro High OG Shoes," a better description is simply *"Men's Shoes."* Instead of "Supreme Box Logo Hoodie," use *"Men's Hoodie."*

The goal is to provide a truthful but uncomplicated description. This practice is standard for personal imports and helps prevent unnecessary scrutiny. Customs officials are processing thousands of packages; a simple, plausible description allows them to process your parcel efficiently. Being overly specific, especially with branded items, can trigger automated flags or manual reviews, leading to unwanted delays.

What is the Correct Value to Declare for My Parcel?

Determining the declared value is arguably the most critical part of the declaration. There is no single "magic number," but the goal is to declare a reasonable and believable value. A common guideline in the community is to declare approximately $12-$15 per kilogram of your parcel's weight. For a 5kg parcel, this would suggest a declared value of around $60-$75. This is a starting point, not a rigid rule.

Under-declaring, such as stating a $20 value for a 10kg parcel filled with shoes and jackets, is a major red flag for customs. It's not believable and invites an inspection. Conversely, over-declaring can cause you to needlessly pay import taxes if the value exceeds your country's tax-free threshold (de minimis value). Always research your country's de minimis value. For example, the threshold for the USA is high ($800), meaning parcels declared below this value are generally not subject to import duties.

Factors Influencing Your Declared Value

Several factors should influence your final declared value beyond the weight-based guideline. Consider the types of items in your parcel; a package full of jackets and shoes is inherently more valuable than one with just t-shirts and socks. The shipping line you choose also matters, as some "tariff-less" lines have very specific declaration ranges you must adhere to. Finally, your destination country's import laws are paramount. Always stay below the tax threshold if possible to avoid duties, but keep the value high enough to be credible.

How Does CNfans Streamline the Customs Declaration Process?

We understand that customs declarations can be intimidating. That's why the CNfans platform is built to make it as straightforward as possible. When you prepare your shipment, our system automatically groups your items and suggests categories, saving you time. The interface clearly lays out where to input descriptions and values, with automatic calculations for total value.

Furthermore, our shipping calculator provides crucial information about each shipping line, including any specific declaration requirements or value ranges. This integrated information helps you make an informed choice that aligns with your declaration strategy. Our goal is to empower you with the tools and information needed to create a compliant and effective customs declaration, reducing stress and increasing the likelihood of a successful delivery.

Which Shipping Lines Have Special Declaration Rules?

Not all shipping lines are treated the same by customs. The method you choose to ship your parcel can have a significant impact on how you should declare your items.

Understanding "Tariff-less" Lines

Many popular shipping routes, often labeled as "Tariff-less" or "Tax-Free," utilize a method called triangle shipping. With these lines, your parcel is first shipped to a transit country in Europe (like the Netherlands or Belgium), where it is cleared through customs. It is then forwarded to your final destination country as an intra-EU shipment, which does not undergo further customs checks.

These lines have very strict declaration requirements. They typically have a narrow range for the declared value (e.g., $18.54 - $21.32) that must be followed precisely. The CNfans shipping page will specify this range. It's crucial to declare a value within this exact window. Deviating from it can result in your parcel being rejected by the logistics provider before it even ships.

Declarations for Express vs. Postal Lines

Express lines (like DHL, FedEx, UPS) are known for speed but also for stricter customs scrutiny. Their clearance processes are more formal. When using these lines, it's vital to have a very reasonable and well-documented declaration, as they are more likely to question low values.

Postal lines (like EMS and its affiliates) are often subject to less rigorous inspection simply due to the sheer volume they handle. This sometimes allows for more flexibility in declaration, but the fundamental principle of declaring a reasonable value still applies to avoid random checks.

What is IOSS and How Does it Impact EU-Bound Parcels?

The Import One-Stop Shop (IOSS) is an electronic system implemented by the European Union. It simplifies the process of declaring and paying VAT on imported goods. When you use a shipping line that supports IOSS, CNfans collects the VAT from you at the time of shipping. This amount is calculated based on your declared value.

The benefit of IOSS is that your parcel arrives in the EU with the VAT already paid. This significantly speeds up customs clearance and prevents the carrier from charging you extra handling fees upon delivery. For IOSS to work correctly, your declared value must be accurate and below the €150 threshold. Declaring a value over €150 will make the parcel ineligible for IOSS, and you will be responsible for paying VAT and potential duties upon arrival.

What are Common Declaration Mistakes You Should Avoid?

Even experienced shippers can make mistakes. Avoiding these common pitfalls will greatly increase your chances of a smooth shipping experience:

- Unrealistic Value: Declaring $15 for a 12kg parcel is an immediate red flag. Use the weight-based guideline as a starting point and adjust for a believable total.

- Using Brand Names: Never declare "Nike," "Gucci," or other brand names. Stick to generic descriptions like "Men's Sneakers" or "Leather Handbag."

- Vague Descriptions: While you should be generic, avoid being too vague. Descriptions like "Gift," "Sample," or "Clothing" are not specific enough. Use "Men's Jacket" or "Women's Jeans" instead.

- Ignoring Shipping Line Rules: Failing to use the specific declaration range for a tariff-less line will cause issues. Always read the line details on CNfans before submitting.

- Declaring Identical Values for Different Items: If you have shoes and socks in your parcel, they should not have the same declared unit value. Assign a higher value to more substantial items.

What Should You Do if a Parcel is Held by Customs?

First, do not panic. A tracking status like "Held at customs" or "Presented to customs" is often a standard part of the process. It does not automatically mean there is a problem. However, if the status persists for several days or you receive a letter, it means customs requires more information.

Typically, they will request a proof of payment or a commercial invoice to verify the value of the goods. You may need to provide screenshots of your order details. It's important to respond to their requests promptly. If they question the nature of the goods, your options may be limited. Honesty and cooperation are often the best policy, but be aware that certain goods may be flagged and potentially confiscated if they violate import laws.

Can Parcel Insurance Cover Customs Seizures?

Parcel insurance offered by CNfans is designed to protect you against loss or damage during transit. This means if your parcel is confirmed lost by the shipping carrier or arrives with significant damage, you may be eligible for compensation according to the policy terms.

However, it is crucial to understand that most standard shipping insurance policies do not cover losses resulting from customs seizure. Customs actions are considered a matter of legal compliance and fall outside the scope of transit-related risks. The responsibility for ensuring a parcel complies with import regulations lies with the importer. Therefore, a careful and well-considered declaration is your best form of protection against customs-related issues.