Clearing customs smoothly with items from a CNfans spreadsheet relies on a strategic and accurate declaration of your parcel's contents and value. The key is to provide details that are reasonable to customs officials while complying with your country's import regulations, especially its de minimis value threshold. This minimizes the chance of delays, inspections, or unexpected fees, ensuring your haul arrives safely.

Table of Contents

- What is Customs Clearance and Why is it Important?

- How Does CNfans Assist in the Customs Process?

- What Key Information Do I Need to Declare?

- How Do I Determine the Correct Declaration Value?

- Which Shipping Line is Best for My Country's Customs?

- Can I Ship Items with Prominent Branding?

- What Common Mistakes Lead to Customs Delays or Seizures?

- What Does My Shipment's Tracking Status Mean?

- What Should I Do if My Parcel is Held by Customs?

- How Can I Prepare My CNfans Parcel for a Smoother Journey?

What is Customs Clearance and Why is it Important?

Customs clearance is the mandatory process of getting goods through the customs authority of a country to facilitate the movement of cargo into a country (import) or out of it (export). When you ship a parcel internationally, it must be "cleared" by the destination country's customs agency before it can be delivered to you. These agencies are responsible for two primary functions: collecting revenue through duties and taxes, and protecting the country's borders by preventing prohibited or dangerous goods from entering.

For anyone purchasing items from a CNfans spreadsheet, understanding this process is crucial. A smooth clearance means your parcel arrives quickly and without extra cost. A problematic clearance, however, can lead to significant delays, requests for more information, the imposition of import taxes, or in worst-case scenarios, the seizure and destruction of your items. Proper preparation is your best tool for a hassle-free experience.

How Does CNfans Assist in the Customs Process?

CNfans acts as your logistics agent, providing you with the tools and services to navigate the complexities of international shipping. It's important to understand that CNfans does not control customs authorities in any country. Instead, it empowers you by executing your specific instructions for the customs declaration. When you are ready to ship your consolidated parcel from the warehouse, the CNfans platform presents you with an interface to declare the contents.

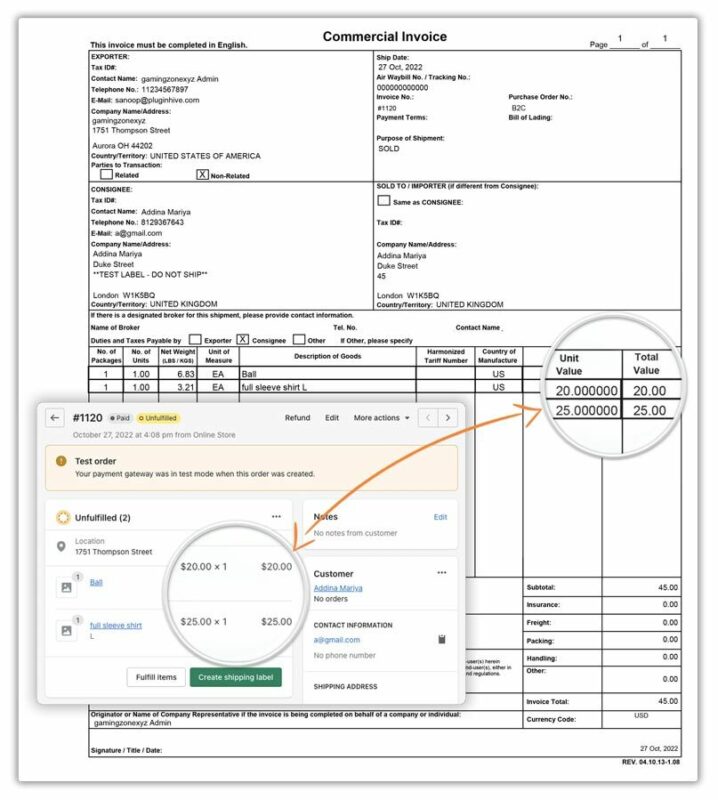

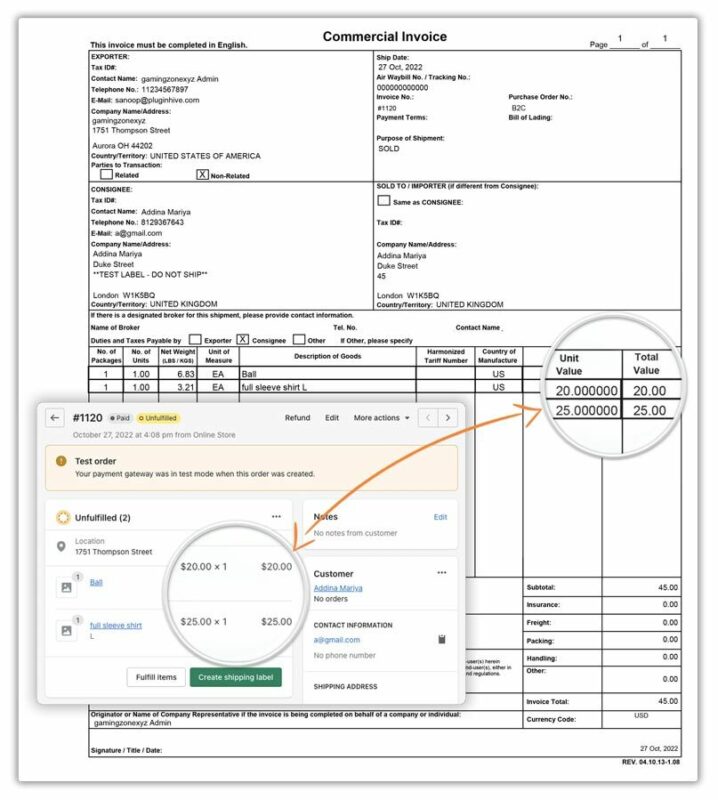

You have direct control over how each item is described and what value is assigned to it. CNfans then uses this information to generate the necessary commercial invoice and shipping labels required by international carriers. Furthermore, the high-quality Quality Check (QC) photos provided for each item in your warehouse are an invaluable resource. They allow you to verify the nature of your products before you even think about shipping, helping you create a more accurate and believable declaration.

What Key Information Do I Need to Declare?

The customs declaration form requires two fundamental pieces of information: the contents of the parcel and their total value. Getting these details right is the cornerstone of a successful customs clearance.

Declaring Item Contents

Accuracy and simplicity are your allies. You must describe what is in the box, but you should avoid being overly specific or using brand names. Customs officials are looking for generic, plausible descriptions. For example, instead of "Streetwear Brand X Graphic Logo T-Shirt," a better description would be "Men's Cotton T-Shirt." Instead of "Designer Y Leather Handbag," use "PU Leather Shoulder Bag." This approach is honest without attracting unnecessary attention to specific brands, which can be a trigger for intellectual property rights (IPR) inspections.

Declaring Item Value

This is the monetary value you assign to the contents of your parcel. This declared value is what customs officials use to determine if your shipment is liable for import duties and taxes. Every country has a "de minimis" value, which is a threshold below which no taxes are collected. Declaring a value below this threshold is a common strategy to avoid extra charges. However, the value must be reasonable and not arouse suspicion.

The Importance of Honesty and Strategy

Your declaration is a legal statement. While strategic declaration is common, outright dishonesty can lead to severe consequences. The goal is to create a declaration that is both low enough to potentially avoid taxes and high enough to be believable. Declaring a 10kg parcel of shoes and jackets with a value of $5 is an immediate red flag for customs officials and will almost certainly lead to an inspection.

How Do I Determine the Correct Declaration Value?

Choosing the right declaration value is more of an art than a science, balancing risk and reward. Several factors should influence your decision.

Understanding De Minimis Value

The de minimis value is the single most important number to know for your destination country. If your declared value is below this amount, your parcel will likely pass through customs without any duties or taxes being assessed. These values vary significantly by country.

| Country | De Minimis Value (Approximate) | Notes |

|---|---|---|

| United States | $800 USD | Very high threshold, making it low-risk for most personal parcels. |

| Canada | $20 CAD (for taxes) / $150 CAD (for duties, by courier) | Complex rules. Shipments valued over $20 CAD are subject to GST/HST. |

| United Kingdom | £135 GBP | VAT is payable on all goods, but this threshold affects how it's collected. |

| Australia | $1,000 AUD | High threshold, generally favorable for importers. |

| European Union | €0 (VAT) / €150 EUR (Duties) | VAT is due on all imports. The IOSS system, used by many CNfans shipping lines, pre-collects this VAT. |

Note: These values are subject to change and should be verified with official government sources.

A Common Declaration Strategy

Within the international shipping community, a widely discussed rule of thumb is the "$12 per kg" method. To use this, you would multiply the weight of your parcel in kilograms by 12 to get a suggested declaration value in USD. For example, a 4kg parcel would be declared at $48. This method helps create a value that scales logically with the weight of the parcel, making it appear more reasonable than a random low number. While not an official rule, it serves as a helpful starting point for many shippers.

What are the Risks of Under-declaring?

Being too aggressive with a low declaration can backfire. If customs officials inspect your parcel and deem the value to be false, they may:

- Re-assess the value: They will assign their own, often much higher, value to the goods and charge you taxes based on that amount.

- Impose a fine: In addition to the taxes, a penalty may be applied for making a false declaration.

- Seize the goods: In cases of severe undervaluation or if the items are found to be counterfeit, the entire parcel could be confiscated.

Which Shipping Line is Best for My Country's Customs?

CNfans offers a variety of shipping lines, and your choice can significantly impact the customs experience. They generally fall into three categories.

Tax-Free / Tariff-Free Lines

These lines are often the most popular for shipping to Europe and Canada. They use a shipping method known as Delivered Duty Paid (DDP). With these lines, the customs clearance process is handled in bulk by the logistics company before the parcel even enters your country. Any applicable VAT is often pre-paid (like through the IOSS system for the EU). This makes them a very reliable and worry-free option, though they may have stricter restrictions on item types and parcel size.

EMS and National Postal Services

Lines like EMS hand off the parcel to your country's national postal service (e.g., USPS in the USA, Canada Post in Canada). These services handle immense volumes, and as a result, their customs clearance process can sometimes be less stringent than express couriers. They are a solid, cost-effective choice, especially for countries with high de minimis thresholds like the United States.

Express Couriers (DHL, FedEx)

Express couriers are known for their speed and detailed tracking. However, they are also known for having a very formal and by-the-book customs clearance process. They will meticulously check the declaration against the parcel's contents and are more likely to assess duties and taxes if the declared value exceeds the de minimis threshold. They are an excellent choice if speed is your top priority and you are confident in your declaration.

Can I Ship Items with Prominent Branding?

Many items found via a CNfans spreadsheet feature designs inspired by popular brands. Shipping these items carries an inherent risk related to Intellectual Property Rights (IPR). Customs agencies have the authority to seize and destroy goods they suspect are counterfeit. While no method is foolproof, you can take steps to minimize this risk.

During the parcel submission process on CNfans, you can opt for value-added services to make your parcel less conspicuous. These include:

- Tag Removal: Removing price tags and brand labels from clothing.

- Simple Packaging: Requesting the removal of branded boxes (like shoeboxes) and using a plain cardboard box.

- Rehearsal Shipping: This service gives you the exact weight and dimensions of your packed parcel, allowing you to perfect your declaration value before you pay for shipping.

Splitting a large haul into several smaller, lighter parcels is also a wise strategy. A single 15kg box is far more likely to draw attention than two 7.5kg boxes.

What Common Mistakes Lead to Customs Delays or Seizures?

Avoiding simple errors can make all the difference. Be mindful of these common pitfalls when preparing your shipment.

Vague or Incorrect Item Descriptions

Descriptions like "Gift," "Sample," or "Daily Necessities" are too vague and are often red flags for customs. Be specific but generic. Instead of "Clothes," list "2x T-Shirt, 1x Jeans." This provides clarity without being overly detailed.

Unrealistic Declaration Values

As mentioned, declaring a heavy parcel at an absurdly low value (e.g., a 7kg box of shoes at $15) defies logic and invites scrutiny. Use a reasonable and scaled approach to valuation to maintain credibility.

Including Prohibited Items

Every shipping line has a list of restricted items. These commonly include batteries, liquids, powders, aerosols, and magnetic items. Attempting to ship these items can result in the parcel being returned to the CNfans warehouse or seized by the airline. Always check the restrictions for your chosen shipping line before submitting your parcel.

Excessively Large or Heavy Parcels

Large, heavy parcels are statistically more likely to be selected for inspection. They represent a greater potential revenue loss if undervalued and are more difficult to process automatically. Keeping your parcels under 10kg and reasonably compact is a good general practice.

What Does My Shipment's Tracking Status Mean?

Once your parcel is in transit, the tracking information can sometimes be confusing. Here are a few key statuses related to customs:

- "Presented to Customs" / "Arrival at Inbound Customs": This is normal. It means your parcel has arrived in the destination country and is in the queue for processing.

- "Held by Customs": This status can be alarming, but it doesn't always mean there's a major problem. It could be a random inspection, a query about the declaration, or a backlog at the facility. Patience is key here.

- "Released from Customs": This is the message you want to see. It means your parcel has cleared the process and has been handed over to the domestic carrier for final delivery.

- "Customs Clearance, Awaiting Payment of Duties/Taxes": This means your parcel was assessed for taxes. The tracking page or a letter from the carrier will provide instructions on how to pay them.

What Should I Do if My Parcel is Held by Customs?

If your parcel's status shows it is being held for more than a few days, don't panic. The first step is to wait for official communication. Customs or the shipping carrier will typically send a letter or email if they require more information or payment. This communication will detail what they need, which could be a proof of payment (like a PayPal screenshot) or a more detailed invoice.

When responding, provide the information requested honestly. If they are questioning the value, you may need to provide proof of what you paid for the items. The outcome can vary: the parcel may be released after you provide the information, you may be required to pay duties and taxes, or in the worst-case scenario of an IPR violation, you may receive a seizure notice. It's important to cooperate with the process as directed.

How Can I Prepare My CNfans Parcel for a Smoother Journey?

A successful delivery starts with smart preparation in your CNfans warehouse. Before you even click "ship," take a moment to run through a final checklist for a customs-friendly parcel.

First, review your items and choose the most appropriate shipping line for your country and the contents. If shipping to Europe, a Tax-Free line is often the safest bet. For the US, EMS is a reliable and cost-effective workhorse. Next, craft a careful and logical declaration. Use generic descriptions and a value that aligns with your country's de minimis threshold and the parcel's weight. Finally, make full use of CNfans' value-added services. Add corner protection and stretch film to make the package durable and waterproof. Consider removing tags and shoeboxes to reduce volume and make the contents less conspicuous. By taking these proactive steps, you significantly increase the probability of your parcel arriving without any customs-related issues.