To create a successful food budget for 2025, start by auditing your current food spending for one month. Next, categorize all expenses like groceries, dining out, delivery, and coffee. Based on this audit, set a realistic monthly budget for each category and use a detailed tool, such as a CNFans Spreadsheet featuring a catering expenditure table, to track every dollar spent. This methodical approach allows you to precisely identify savings opportunities and gain full control over your culinary finances.

Table of Contents

- Why a Food Budget is Crucial for 2025

- Understanding the Catering Expenditure Table

- Phase 1: Auditing Your Current Food Spending

- Phase 2: Structuring Your 2025 Food Budget

- The Ultimate Tool for Financial Control

- How to Build Your Budget with the CNFans Spreadsheet

- Mastering the Catering Expenditure Table for Events

- Advanced Strategies to Reduce Your Grocery Bill

- Adjusting Your Food Budget: When and How

- Avoiding Common Food Budgeting Pitfalls

Why a Food Budget is Crucial for 2025

As we look toward 2025, managing household finances effectively has never been more critical. Food costs, in particular, represent a significant and variable portion of any budget. Without a clear plan, these expenses can easily spiral, impacting your ability to save, invest, or meet other financial goals. A dedicated food budget is not about restriction; it is about empowerment. It provides a clear picture of where your money is going, enabling you to make intentional decisions that align with your financial priorities.

Creating a food spending plan helps you combat the effects of inflation by forcing a more mindful approach to consumption. It transforms passive spending into active financial management. You gain the ability to identify wasteful habits, optimize your grocery shopping, and plan for larger expenses like holiday meals or parties without incurring debt. A well-structured budget is the bedrock of financial wellness, and mastering your food expenditure is a major step toward achieving it.

Understanding the Catering Expenditure Table

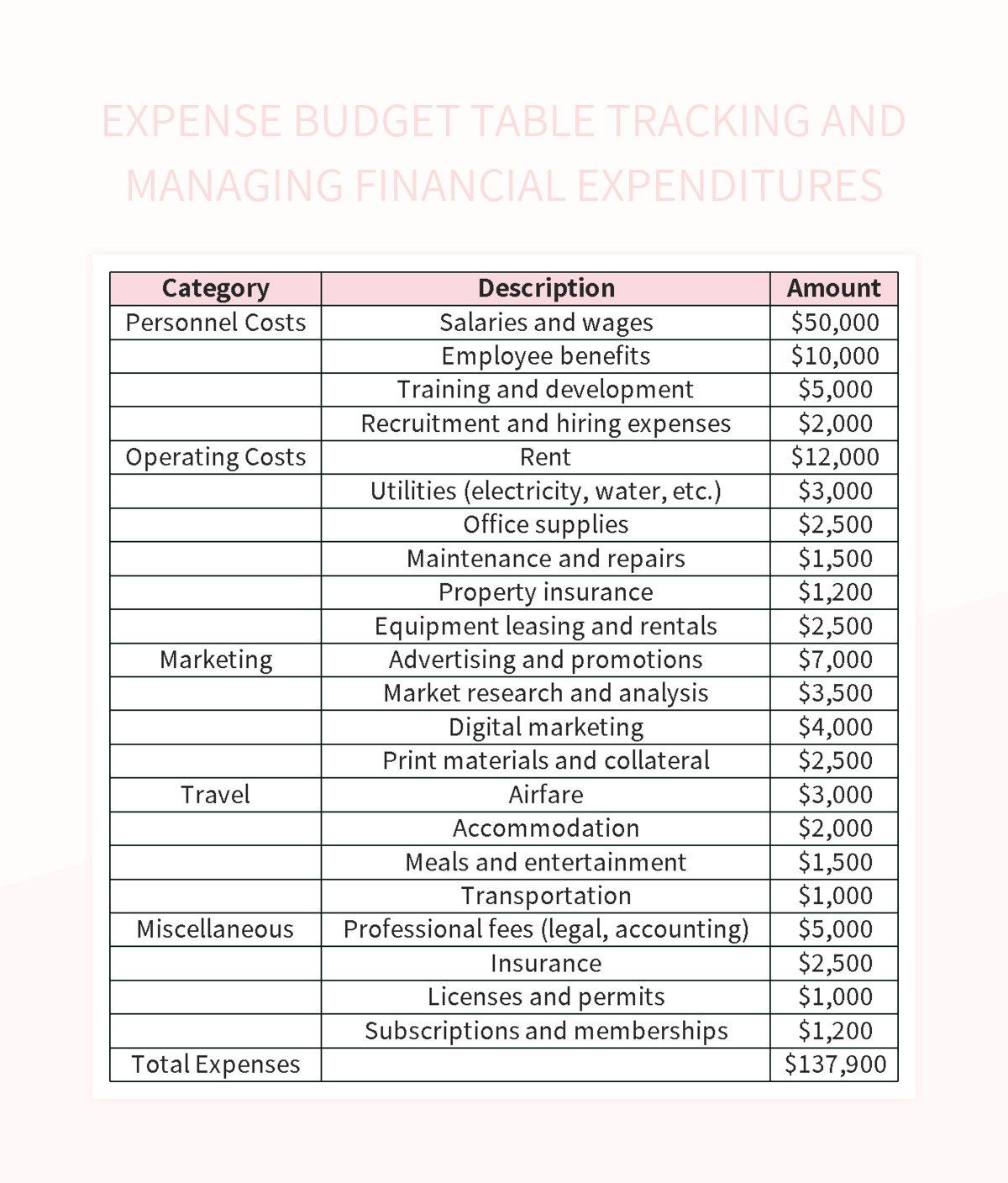

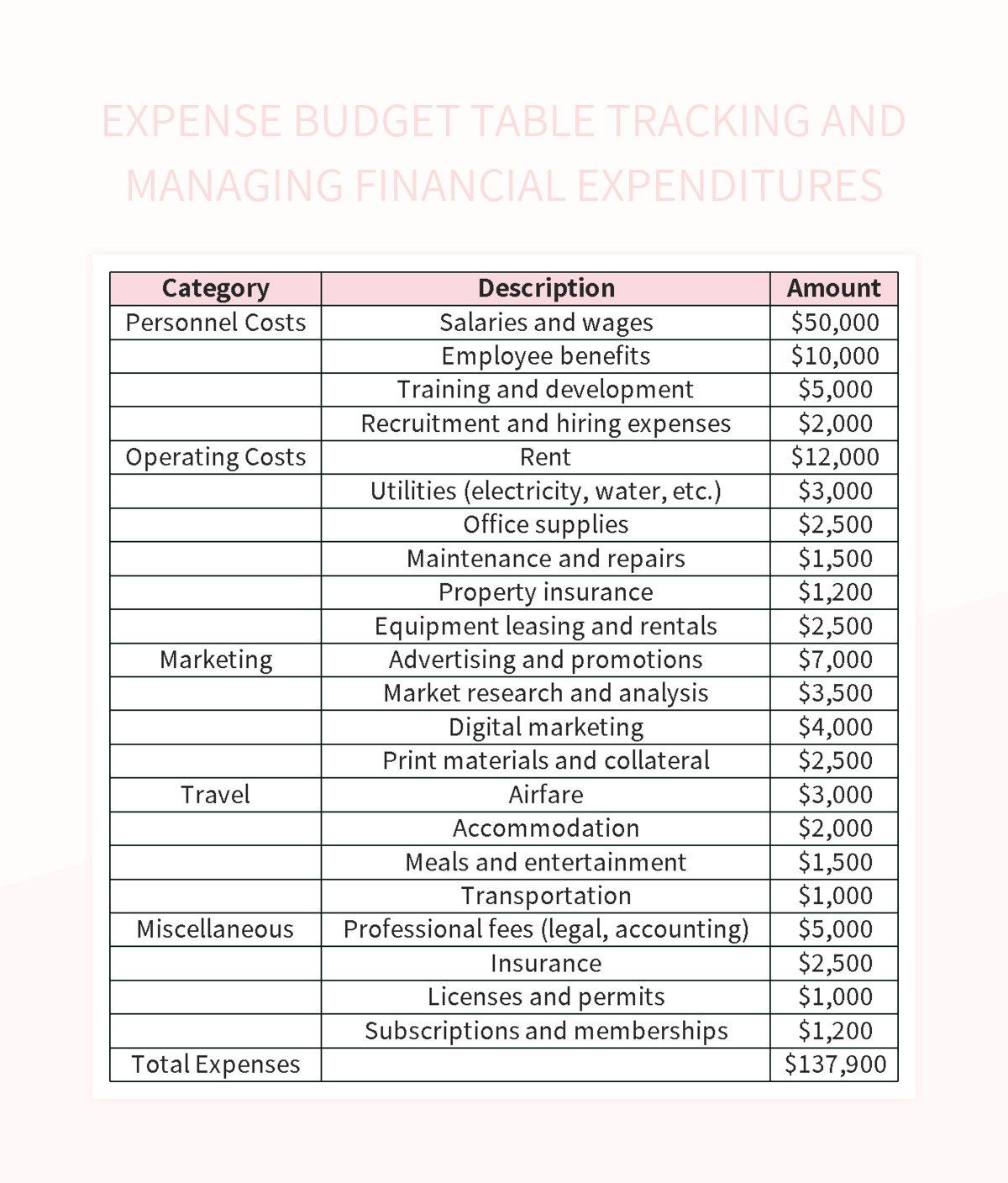

A Catering Expenditure Table is a specialized budgeting tool designed for planning and tracking the costs associated with any event involving food, from a small family gathering to a large celebration. Unlike a simple grocery list, this table is a comprehensive financial planner. It breaks down expenses by category, such as ingredients, beverages, supplies (plates, napkins), and even labor or service costs if applicable. It allows you to set a budget per item or per person, track actual spending against estimates, and make informed adjustments on the fly.

This level of detail is invaluable for anyone who entertains or manages household events. It prevents the common problem of overspending on parties and special occasions. By projecting costs accurately, you can host confidently, knowing that the financial aspect is under complete control. This methodical approach turns a potentially stressful part of event planning into a simple, manageable process.

Phase 1: Auditing Your Current Food Spending

Before you can set a realistic budget for the future, you must understand your past and present. The first and most important step is to conduct a thorough audit of your food-related expenditures. This process involves tracking every single dollar you spend on food and drink for at least one full month. It’s an eye-opening exercise that reveals the truth about your spending habits, often highlighting areas of unconscious overspending, such as daily coffees, frequent food deliveries, or impulse buys at the grocery store.

How to Track Your Expenses Effectively

Consistency is key during the auditing phase. Choose a method and stick with it. While you can use a simple notebook, a digital tool offers far greater efficiency and analytical power. At the end of each day, log all your food-related receipts. This includes everything: morning lattes, lunch with colleagues, weekly grocery hauls, late-night snacks, and takeout orders. Be meticulous. The goal is to capture a complete and honest dataset that will serve as the foundation for your 2025 budget.

Analyzing Your Spending Patterns

Once you have a month's worth of data, it's time for analysis. Tally up the totals to see the big picture: how much did you spend in total on food? Then, dig deeper. Categorize each expense to see where your money truly went. Common categories include groceries, restaurants/dining out, coffee shops, food delivery services, and alcohol. This breakdown will reveal your primary cost centers and show you precisely where the opportunities for savings lie. You might be surprised to find that your daily coffee habit costs more per month than a portion of your grocery bill.

Phase 2: Structuring Your 2025 Food Budget

With a clear understanding of your spending habits, you can now build a forward-looking food budget for 2025. This is where you move from analysis to action, setting clear financial boundaries that are both ambitious and attainable. The structure of your budget is critical; it must be detailed enough to be useful but simple enough to be manageable.

Defining Essential Budget Categories

Using the analysis from your audit, create specific categories for your new budget. These should reflect your unique lifestyle. A good starting point is to use the same categories from your audit, but you may want to refine them. For instance, you could split "Groceries" into sub-categories like "Produce," "Meat & Dairy," and "Pantry Staples" for even greater control. A comprehensive list might look like this:

- Groceries: Food and supplies purchased for home cooking.

- Dining Out: Meals at restaurants, cafes, and diners.

- Food Delivery: Services like Uber Eats or DoorDash.

- Coffee Shops: Daily or weekly coffee and pastry runs.

- Work Lunches: Food purchased during the workday.

- Entertainment/Events: Costs for hosting parties or special meals.

Allocating Funds Realistically

Now, assign a dollar amount to each category for the month. This is the most crucial part of setting your budget. Be realistic. If your audit showed you spent $400 on dining out, setting a new budget of $50 is likely to fail. Instead, aim for a gradual reduction, perhaps to $300, and lower it further as you adapt. Your total budget should align with your overall financial goals. The aim is to create a plan that challenges you to be more mindful without feeling overly restrictive.

The Ultimate Tool for Financial Control

While budgeting principles are universal, the tool you use to implement them makes all the difference. Generic apps can be rigid, and pen and paper lack analytical power. For ultimate flexibility and control, a customizable spreadsheet is unmatched. The CNFans Spreadsheet is engineered for this exact purpose, providing a robust, user-friendly platform to build and manage a highly detailed financial plan.

Unlike one-size-fits-all solutions, this spreadsheet gives you the power to design a system that perfectly matches your life. You can create custom categories, build dynamic dashboards, and integrate specialized tools like a Catering Expenditure Table directly into your primary budget. This centralization simplifies tracking and provides a holistic view of your finances, a feature rarely found in standard budgeting apps. It’s a tool built for those who want to be in the driver’s seat of their financial journey.

How to Build Your Budget with the CNFans Spreadsheet

Putting the CNFans Spreadsheet into action is straightforward. Its intuitive design allows you to quickly translate your budgetary goals into a functional, dynamic document. You can create a central hub for your entire food budget, from daily spending to elaborate event planning.

Setting Up Your Dashboard

The first step is to create your main budget dashboard. Set up columns for your chosen categories (Groceries, Dining Out, etc.). For each category, create a "Budgeted" column where you input your monthly goal and an "Actual" column where you will log expenses as they occur. This side-by-side view gives you an immediate, real-time understanding of your performance. You can see at a glance if you are on track, overspending, or have a surplus in a particular area.

Automating Calculations and Summaries

The true power of the spreadsheet comes from automation. Use simple formulas to create a "Difference" column that automatically subtracts your "Actual" spending from your "Budgeted" amount. You can use color-coding to make this even more visual: green for under budget, red for over. Additionally, create a summary section at the top of your sheet that totals all budgeted amounts and all actual spending. This gives you a high-level view of your overall progress for the month without needing to manually add up numbers.

Mastering the Catering Expenditure Table for Events

For anyone who hosts holiday dinners, birthday parties, or even regular family get-togethers, a Catering Expenditure Table is a game-changer. Within your main CNFans Spreadsheet, you can create a separate tab dedicated to this function. This tool helps you plan with precision and avoid the last-minute financial stress that often accompanies hosting.

Your table should be structured to capture all potential costs. Here is an example of an effective layout:

| Item/Category | Estimated Cost | Actual Cost | Notes |

|---|---|---|---|

| Appetizers (e.g., cheese, crackers) | $40.00 | $37.50 | Bought on sale |

| Main Course (e.g., turkey, ham) | $75.00 | $82.00 | Higher price per pound than expected |

| Beverages (soda, juice, wine) | $50.00 | $45.00 | Used store-brand soda |

| Supplies (plates, napkins, cups) | $25.00 | $25.00 | |

| Total | $190.00 | $189.50 | Under budget by $0.50 |

Before shopping, fill out the 'Item/Category' and 'Estimated Cost' columns. This becomes your shopping list and your budget. As you purchase items, fill in the 'Actual Cost'. This allows you to see where you are over or under your estimate, enabling you to adjust other areas if needed. The total from this table can then be logged as a single entry ('Holiday Dinner') in your main monthly budget.

Advanced Strategies to Reduce Your Grocery Bill

Once your budget is established and you are consistently tracking expenses, you can begin implementing strategies to actively lower your spending. Your grocery bill is often the area with the most flexibility and potential for savings. This requires a proactive approach centered on planning and smart shopping.

Strategic Meal Planning

Meal planning is the single most effective strategy for cutting grocery costs. Before you go to the store, plan your meals for the week—breakfasts, lunches, and dinners. This does two things: first, it ensures you buy only what you need, drastically reducing food waste. Second, it eliminates the "what's for dinner?" stress that often leads to expensive takeout orders. Check your pantry, fridge, and freezer first, and build your meal plan around ingredients you already have. Your shopping list should then only contain the items needed to complete those meals.

Smart Shopping Techniques

Transform how you shop by adopting a few key habits. Never shop hungry, as this leads to impulse buys. Stick to your list—if it’s not on the list, you don't need it. Compare unit prices to ensure you are getting the best value, as a larger package is not always cheaper per ounce or pound. Embrace store brands, which often offer identical quality to name brands at a fraction of the cost. Finally, consider buying non-perishable staples in bulk when they are on sale, but only if you have the storage space and will realistically use them before they expire.

Adjusting Your Food Budget: When and How

A budget is not a static document; it is a living plan that should evolve with your life. It is important to review and adjust your food budget periodically. A monthly check-in is ideal for making small tweaks, but a more thorough review should be done quarterly or whenever a significant life change occurs, such as a change in income, a new household member, or a shift in dietary needs.

If you consistently find yourself overspending in a certain category despite your best efforts, your initial budget may have been unrealistic. It is better to adjust the budget to a more attainable number than to abandon it altogether. Conversely, if you are consistently under budget, you can reallocate that surplus. You might choose to put it toward savings, pay down debt, or treat yourself to a nice meal out—the choice is yours, because you are in control.

Avoiding Common Food Budgeting Pitfalls

Many people attempt to budget but fail due to a few common mistakes. One of the biggest is setting an overly restrictive budget from the start. A budget that leaves no room for flexibility or the occasional treat is destined to fail. It is better to start with modest goals and tighten the budget over time as you build new habits. Another pitfall is inconsistent tracking. Missing a few days of logging expenses can quickly derail your entire month's data, making it impossible to know where you stand. Commit to tracking every expense, every day.

Finally, avoid the all-or-nothing mindset. If you go over budget in one category, do not see it as a total failure. The month is not ruined. Simply acknowledge it, see if you can cut back in another area to compensate, and aim to do better next week. The goal of a food budget is not perfection; it is progress and mindful financial management over the long term.