An annual budget table is a comprehensive financial document that outlines your projected income, expenses, savings, and debt repayment over an entire year. For 2025, creating one is the single most effective step you can take toward achieving financial stability and reaching your long-term goals. It provides a clear roadmap, transforming abstract financial aspirations into a concrete, actionable plan. By meticulously tracking every dollar, you empower yourself to make informed decisions, identify wasteful spending, and strategically allocate funds to what truly matters.

Table of Contents

- What Defines an Effective Annual Budget Table?

- Why is Financial Planning for 2025 More Critical Than Ever?

- Foundational Steps to Build Your 2025 Budget

- Popular Budgeting Strategies to Consider

- How Do You Effectively Manage Discretionary Spending?

- Introducing the Cnfans Spreadsheet Annual Budget Table: A Specialized Tool for Smart Shoppers

- What Are the Key Components of a Comprehensive Budget Spreadsheet?

- Common Pitfalls in Annual Budgeting and How to Avoid Them

- Adjusting Your Budget: How Often Should You Review and Revise?

- Beyond Budgeting: What Are the Next Steps in Your Financial Journey?

What Defines an Effective Annual Budget Table?

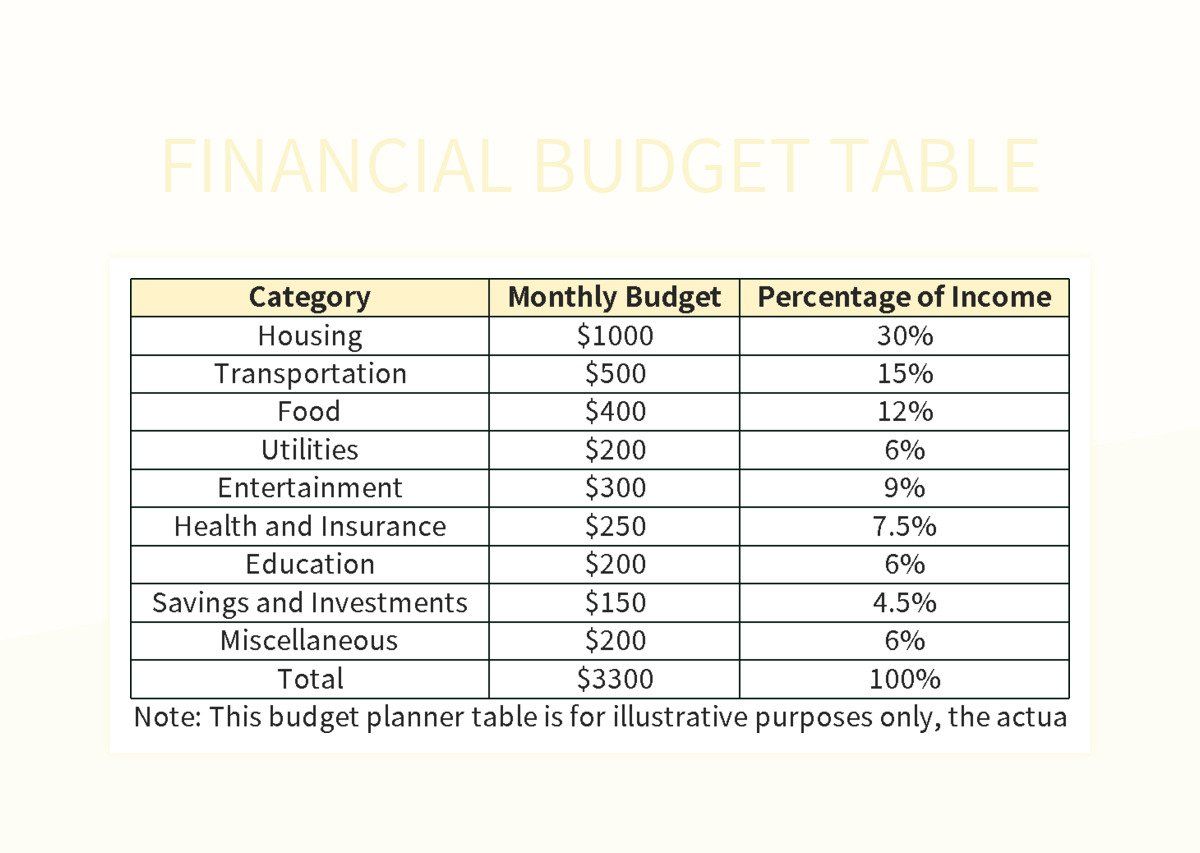

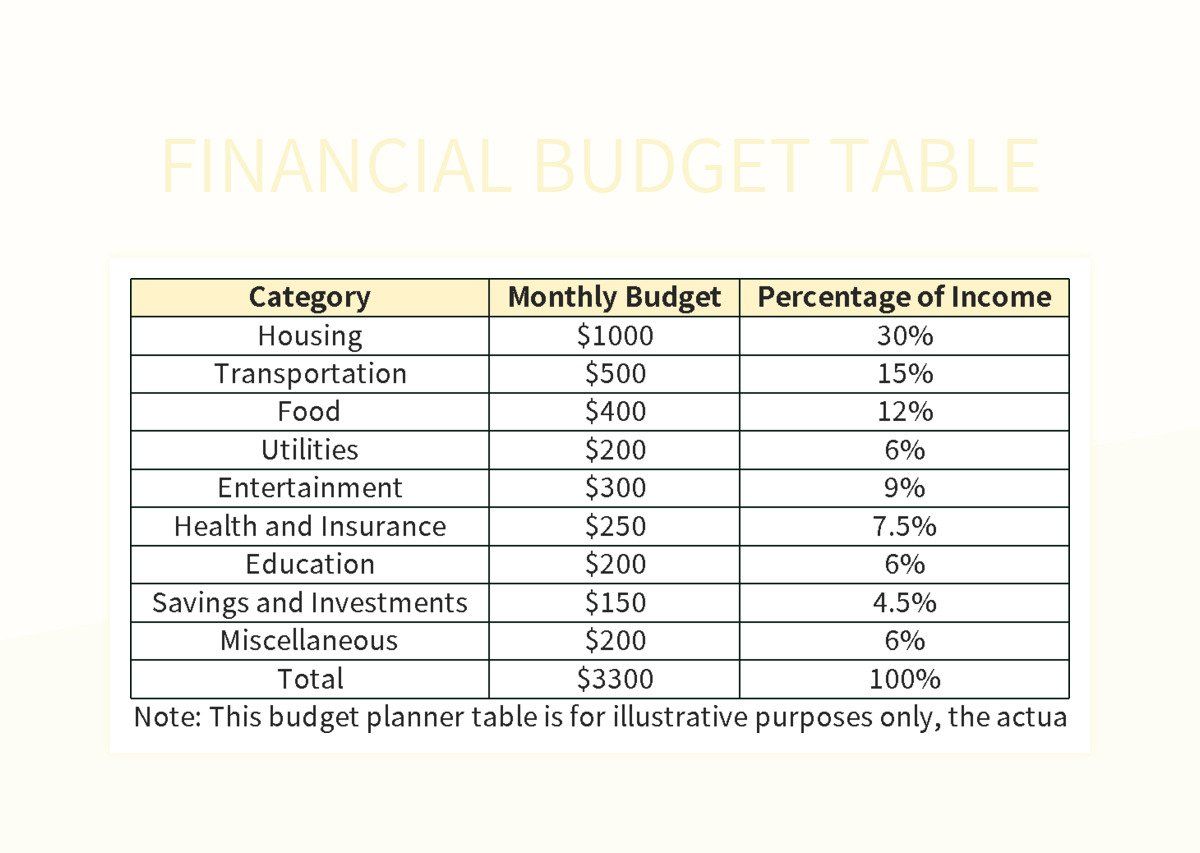

An effective annual budget table is more than just a list of numbers; it's a dynamic tool characterized by several key attributes. Firstly, it must be comprehensive, capturing all sources of income and every category of expense, from fixed costs like rent to variable spending on groceries and entertainment. Secondly, it needs to be realistic. A budget based on wishful thinking is destined to fail. It should reflect your actual spending habits and income, providing a truthful baseline from which to make adjustments.

Furthermore, a powerful budget is goal-oriented. It directly links your daily spending habits to your larger life objectives, such as saving for a down payment, paying off debt, or investing for retirement. This connection provides motivation and purpose. Finally, the best budget tables are flexible. Life is unpredictable; your budget should be able to accommodate unexpected expenses or changes in income without completely falling apart. It acts as a resilient framework, not a rigid prison, guiding your financial decisions throughout the year.

Why is Financial Planning for 2025 More Critical Than Ever?

As we approach 2025, the global economic landscape continues to present both challenges and opportunities. Fluctuating inflation rates, evolving job markets, and shifting consumer prices make proactive financial management a necessity, not a luxury. Without a solid plan, it is easy to fall behind, see savings erode, and lose sight of financial goals. A well-structured budget for 2025 serves as your personal economic stabilizer, providing clarity and control amidst uncertainty.

Strategic financial planning allows you to anticipate potential financial stressors and build a buffer against them. It enables you to capitalize on opportunities, whether that's investing during a market dip or having the funds available for a career-enhancing certification. By taking command of your finances now, you are not just preparing for the next twelve months; you are laying a foundation for long-term wealth creation and financial independence. It's about shifting from a reactive stance, where you are constantly responding to financial events, to a proactive one, where you are directing your financial future.

Foundational Steps to Build Your 2025 Budget

Building a robust annual budget involves a systematic process. By breaking it down into manageable steps, you can create a detailed and accurate financial plan for the year ahead without feeling overwhelmed. This structured approach ensures no detail is overlooked.

Step 1: Calculate Your Total Annual Income

The first step is to determine exactly how much money you have coming in. This is your net income, which is your take-home pay after taxes, insurance premiums, and other deductions are subtracted from your gross earnings. Gather your pay stubs, employment contracts, and any other relevant documents.

Sum up all sources of income for the year. This includes your primary salary, any side hustle earnings, freelance income, investment dividends, or other regular cash inflows. If your income is variable (e.g., you are a freelancer or work on commission), it's wise to use a conservative estimate based on your previous year's earnings or your lowest-earning month to create a safe baseline.

Step 2: Categorize and Track Your Expenses

Understanding where your money goes is crucial. Review the past three to six months of your bank and credit card statements to get an accurate picture of your spending habits. Group your expenses into logical categories. The main categories are:

- Fixed Expenses: Costs that remain the same each month, such as rent/mortgage, car payments, insurance premiums, and loan repayments.

- Variable Expenses: Costs that fluctuate, such as groceries, gasoline, utilities, and dining out.

- Discretionary Expenses: Non-essential spending on wants, like hobbies, entertainment, shopping, and travel. This category often requires the most careful management, especially when it involves complex purchases like international shopping hauls where you must track item costs, agent fees, currency conversion, and international shipping.

Tally up the average monthly spending in each category and multiply by twelve to get an annual estimate. This process will illuminate areas where you might be overspending and where cuts can be made.

Step 3: Define Your 2025 Financial Goals

What do you want to accomplish with your money in 2025? Your goals are the "why" behind your budget. They should be SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. Instead of a vague goal like "save more money," aim for something specific like "save $6,000 for an emergency fund by December 31, 2025," which requires saving $500 per month.

Common financial goals include building an emergency fund (typically 3-6 months of living expenses), paying off high-interest debt, saving for a down payment on a house, or contributing a certain percentage of your income to retirement accounts. Prioritize your goals and integrate them directly into your budget as a non-negotiable line item, similar to a fixed expense.

Popular Budgeting Strategies to Consider

There is no one-size-fits-all approach to budgeting. The best method is one you can stick with consistently. Two of the most effective and popular strategies offer different frameworks for managing your money.

The 50/30/20 Method: A Balanced Approach

This strategy is popular for its simplicity and flexibility. It divides your after-tax income into three categories:

- 50% for Needs: This portion covers all your essential living expenses. This includes housing, transportation, groceries, utilities, and insurance—the costs you absolutely must pay to live.

- 30% for Wants: This is for discretionary spending. It covers hobbies, dining out, entertainment, shopping, and other non-essential items that enhance your quality of life.

- 20% for Savings & Debt Repayment: This final portion is dedicated to your financial goals. It includes contributions to your emergency fund, retirement accounts, investments, and payments toward high-interest debt beyond the minimums.

The 50/30/20 rule provides a straightforward benchmark to assess if your spending is balanced and aligned with long-term financial health.

Zero-Based Budgeting: Assigning Every Dollar a Job

Zero-based budgeting is a more meticulous method that requires you to account for every single dollar of your income. The formula is simple: Income - Expenses - Savings - Debt Repayments = 0. At the start of each month (or pay period), you create a plan that allocates all of your income to specific categories.

This method forces you to be highly intentional with your money. There's no "leftover" cash to be spent mindlessly. Every dollar has a purpose, whether it's for rent, groceries, a savings goal, or entertainment. This approach is excellent for those who want maximum control over their finances and are looking to optimize their spending and saving potential.

How Do You Effectively Manage Discretionary Spending?

Discretionary spending, or the "Wants" category, is often the most challenging area of a budget to control. This is where impulse buys and lifestyle creep can derail even the best-laid plans. Effective management here is not about deprivation, but about mindful allocation. The key is to plan for your hobbies and enjoyment rather than letting them happen by accident.

For hobbies that involve numerous small transactions, like collecting, gaming, or international shopping, tracking can become incredibly complex. You might be dealing with multiple vendors, currency conversions, platform fees, and consolidated shipping costs. A generic budget spreadsheet often fails to capture this complexity, leading to inaccurate tracking and budget overruns. To truly master this spending, you need a tool specifically designed to handle these nuances, allowing you to see the total cost of your hobby and ensure it fits within your 30% "Wants" allocation.

Introducing the Cnfans Spreadsheet Annual Budget Table: A Specialized Tool for Smart Shoppers

For individuals who enjoy international shopping through platforms like Pandabuy, Sugargoo, or Wegobuy, managing expenses is a unique challenge. This is precisely where the Cnfans Spreadsheet Annual Budget Table excels. It is not just another generic budgeting template; it is a purpose-built solution crafted by experts who understand the intricate details of haul-based shopping.

This specialized spreadsheet transforms chaotic expense tracking into a streamlined, automated process. It allows users to meticulously log each item's cost, domestic shipping fees, agent service fees, and international shipping charges. With features for automatic currency conversion, weight estimation, and shipping cost calculation, it provides a true, all-in cost for your shopping hauls. By integrating this powerful tool into your 2025 financial plan, you can accurately budget for your hobby, prevent overspending, and make smarter purchasing decisions without giving up what you enjoy.

What Are the Key Components of a Comprehensive Budget Spreadsheet?

Whether you use a specialized tool or build your own, a truly functional budget spreadsheet must contain several essential components. These elements work together to provide a holistic view of your financial life.

| Component | Description | Importance for 2025 Planning |

|---|---|---|

| Income Tracker | A section to list all sources of monthly and annual net income. | Provides the baseline amount of money you have available to allocate. |

| Expense Categories | Detailed line items for fixed, variable, and discretionary spending. | Helps identify where money is going and where adjustments can be made. |

| Budget vs. Actual Columns | Columns to compare your planned budget with your actual spending for each category. | Reveals variances and highlights areas of overspending or successful saving. |

| Savings & Debt Goal Tracker | A dedicated area to monitor progress toward specific financial goals. | Keeps you motivated by visualizing how close you are to your objectives. |

| Annual Summary Dashboard | A high-level visual summary of your total income, expenses, and savings for the year. | Offers a quick, at-a-glance health check of your overall financial picture. |

| Net Worth Calculator | A simple calculation of your assets (what you own) minus your liabilities (what you owe). | Measures your long-term financial growth and progress over time. |

Common Pitfalls in Annual Budgeting and How to Avoid Them

Many people start a budget with enthusiasm, only to abandon it a few months later. This is often due to a few common mistakes. One major pitfall is creating an unrealistic budget. If you drastically cut all discretionary spending, you're setting yourself up for failure. A budget should be challenging but sustainable. Allow for some fun money to avoid burnout.

Another frequent issue is infrequent tracking. Waiting until the end of the month to log your expenses can lead to surprises and make it difficult to course-correct. Make a habit of tracking your spending daily or weekly. A third mistake is failing to plan for irregular or unexpected expenses, such as annual subscriptions, car repairs, or medical bills. Avoid this by creating "sinking funds"—small monthly savings pools designated for these specific, foreseeable costs.

Adjusting Your Budget: How Often Should You Review and Revise?

An annual budget is not a "set it and forget it" document. Your financial situation and priorities can change throughout the year, and your budget needs to adapt accordingly. A regular review process is essential for success. Plan for a brief weekly check-in to track your spending and ensure you're on course. This takes only a few minutes and helps prevent small deviations from becoming major problems.

Conduct a more thorough monthly review. This is your opportunity to analyze the "Budget vs. Actual" data, understand why you may have overspent in certain areas, and make adjustments for the upcoming month. Finally, schedule a quarterly or semi-annual deep dive. Use this time to review your progress toward your big financial goals, reassess if those goals are still relevant, and make major adjustments to your budget in response to significant life changes like a raise, a new job, or a change in family size.

Beyond Budgeting: What Are the Next Steps in Your Financial Journey?

Mastering your 2025 budget is a monumental achievement, but it's the first step on a larger path to financial well-being. Once you have consistent control over your cash flow, you can focus on building long-term wealth. The next logical steps involve optimizing the money you are saving.

Consider educating yourself on investing. With your budget freeing up capital, you can begin channeling funds into retirement accounts like a 401(k) or IRA, or into a brokerage account to invest in stocks, bonds, and ETFs. Focus on automating your savings and investments so that a portion of every paycheck is put to work for your future before you even have a chance to spend it. Continuously increasing your financial literacy will empower you to make smarter decisions, grow your net worth, and ultimately achieve true financial freedom.